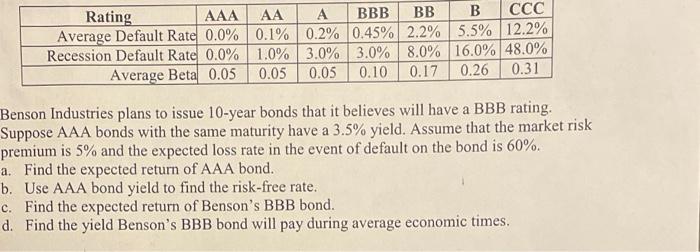

Question: please show all work and formulas Rating AAAAA A BBB BB B CCC Average Default Rate 0.0% 0.1% 0.2% 0.45% 2.2% 5.5% 12.2% Recession Default

Rating AAAAA A BBB BB B CCC Average Default Rate 0.0% 0.1% 0.2% 0.45% 2.2% 5.5% 12.2% Recession Default Rate 0.0% 1.0% 3.0% 3.0% 8.0% 16.0% 48.0% Average Beta 0.05 0.05 0.05 0.100.17 0.26 0.31 Benson Industries plans to issue 10-year bonds that it believes will have a BBB rating. Suppose AAA bonds with the same maturity have a 3.5% yield. Assume that the market risk premium is 5% and the expected loss rate in the event of default on the bond is 60%. a. Find the expected return of AAA bond. b. Use AAA bond yield to find the risk-free rate. c. Find the expected return of Benson's BBB bond. d. Find the yield Benson's BBB bond will pay during average economic times. Rating AAAAA A BBB BB B CCC Average Default Rate 0.0% 0.1% 0.2% 0.45% 2.2% 5.5% 12.2% Recession Default Rate 0.0% 1.0% 3.0% 3.0% 8.0% 16.0% 48.0% Average Beta 0.05 0.05 0.05 0.100.17 0.26 0.31 Benson Industries plans to issue 10-year bonds that it believes will have a BBB rating. Suppose AAA bonds with the same maturity have a 3.5% yield. Assume that the market risk premium is 5% and the expected loss rate in the event of default on the bond is 60%. a. Find the expected return of AAA bond. b. Use AAA bond yield to find the risk-free rate. c. Find the expected return of Benson's BBB bond. d. Find the yield Benson's BBB bond will pay during average economic times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts