Question: Please show all work and write neatly so I can follow along and understand please. HOMEWORK #7 CASH FLOW COMPUTATION FOR A REPLACEMENT PROBLEM Given

Please show all work and write neatly so I can follow along and understand please.

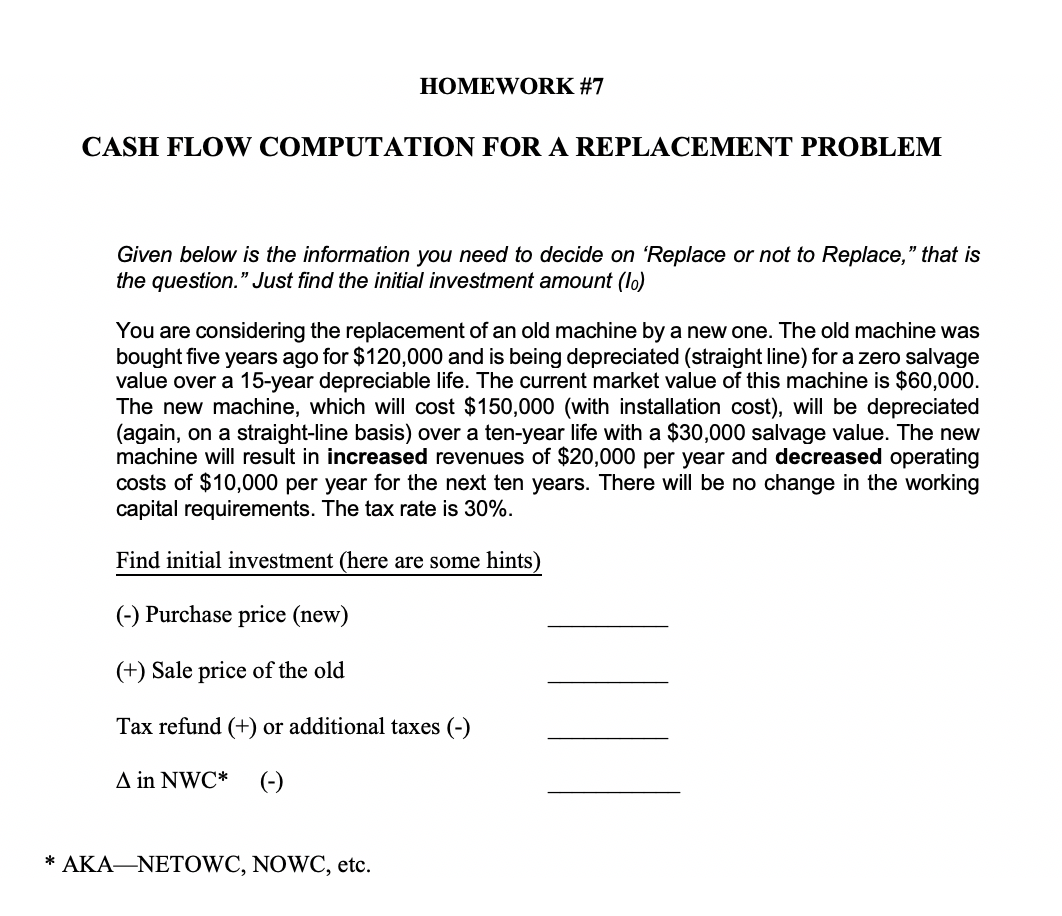

HOMEWORK #7 CASH FLOW COMPUTATION FOR A REPLACEMENT PROBLEM Given below is the information you need to decide on 'Replace or not to Replace," that is the question." Just find the initial investment amount (10) You are considering the replacement of an old machine by a new one. The old machine was bought five years ago for $120,000 and is being depreciated (straight line) for a zero salvage value over a 15-year depreciable life. The current market value of this machine is $60,000. The new machine, which will cost $150,000 (with installation cost), will be depreciated (again, on a straight-line basis) over a ten-year life with a $30,000 salvage value. The new machine will result in increased revenues of $20,000 per year and decreased operating costs of $10,000 per year for the next ten years. There will be no change in the working capital requirements. The tax rate is 30%. Find initial investment (here are some hints) (-) Purchase price (new) (+) Sale price of the old Tax refund (+) or additional taxes (-) A in NWC* (-) * AKANETOWC, NOWC, etc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts