Question: Please show all work. Consider a 1-year futures contract on an investment asset that provides no income. It costs S2 per unit to store the

Please show all work.

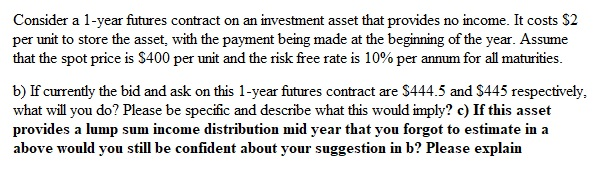

Consider a 1-year futures contract on an investment asset that provides no income. It costs S2 per unit to store the asset, with the payment being made at the beginning of the year. Assume that the spot price is $400 per unit and the risk free rate is 10% per annum for all maturities. b) If currently the bid and ask on this 1-year futures contract are S444.5 and S445 respectively, what will you do? Please be specific and describe what this would imply? c) If this asset provides a lump sum income distribution mid year that you forgot to estimate in a above would you still be confident about your suggestion in b? Please explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts