Question: PLEASE SHOW ALL WORK EITHER THROUGH EXCELL, WORD, OR WRITTEN! TY! Problem 1 - Income tax formula Bryan and Lily, both aged 35, are married

PLEASE SHOW ALL WORK EITHER THROUGH EXCELL, WORD, OR WRITTEN! TY!

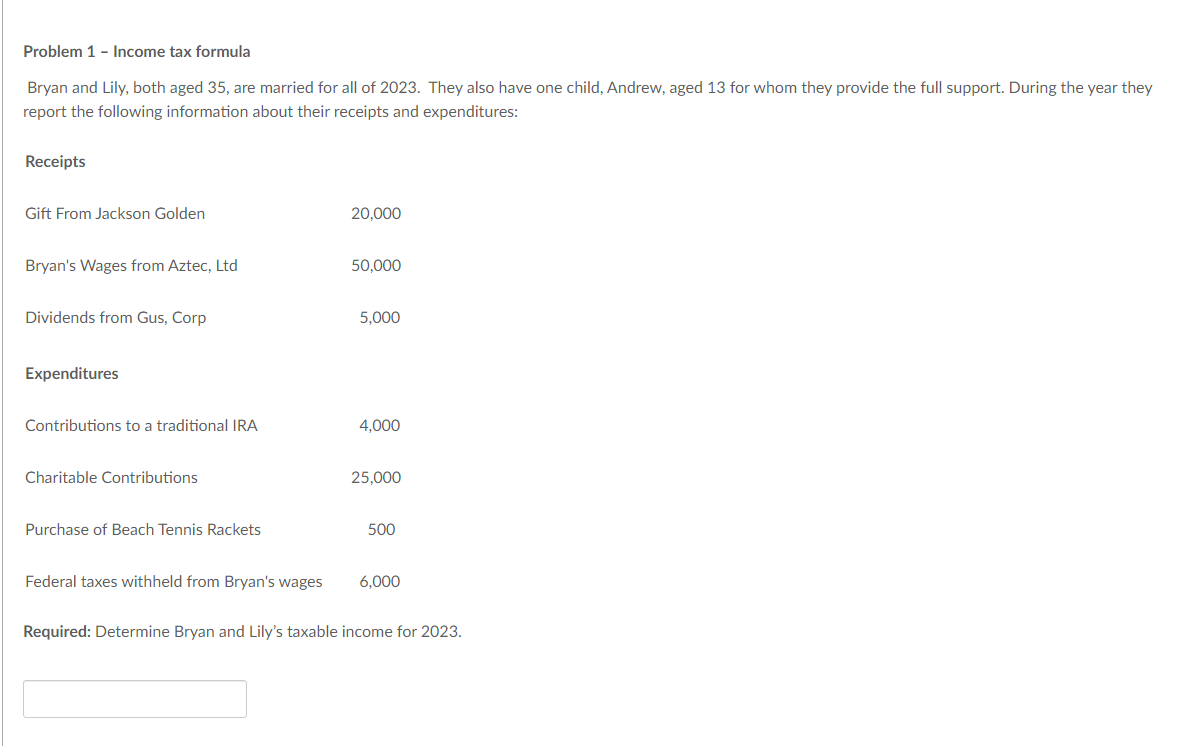

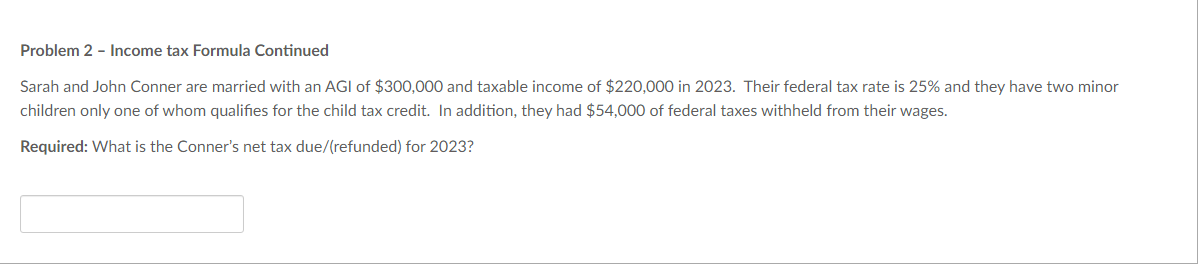

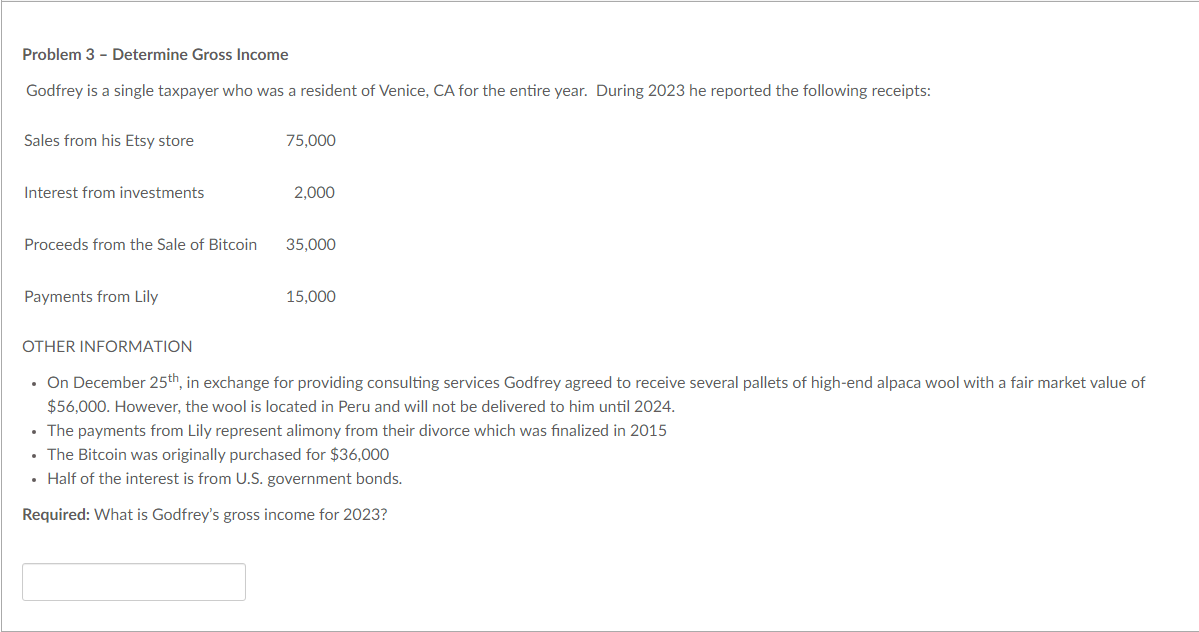

Problem 1 - Income tax formula Bryan and Lily, both aged 35, are married for all of 2023. They also have one child, Andrew, aged 13 for whom they provide the full support. During the year they report the following information about their receipts and expenditures: Required: Determine Bryan and Lily's taxable income for 2023. Problem 3 - Determine Gross Income Godfrey is a single taxpayer who was a resident of Venice, CA for the entire year. During 2023 he reported the following receipts: OTHER INFORMATION - On December 25th, in exchange for providing consulting services Godfrey agreed to receive several pallets of high-end alpaca wool with a fair market value of $56,000. However, the wool is located in Peru and will not be delivered to him until 2024. - The payments from Lily represent alimony from their divorce which was finalized in 2015 - The Bitcoin was originally purchased for $36,000 - Half of the interest is from U.S. government bonds. Required: What is Godfrey's gross income for 2023? Problem 2 - Income tax Formula Continued Sarah and John Conner are married with an AGI of $300,000 and taxable income of $220,000 in 2023 . Their federal tax rate is 25% and they have two minor children only one of whom qualifies for the child tax credit. In addition, they had $54,000 of federal taxes withheld from their wages. Required: What is the Conner's net tax due/(refunded) for 2023 ? Problem 1 - Income tax formula Bryan and Lily, both aged 35, are married for all of 2023. They also have one child, Andrew, aged 13 for whom they provide the full support. During the year they report the following information about their receipts and expenditures: Required: Determine Bryan and Lily's taxable income for 2023. Problem 2 - Income tax Formula Continued Sarah and John Conner are married with an AGI of $300,000 and taxable income of $220,000 in 2023 . Their federal tax rate is 25% and they have two minor children only one of whom qualifies for the child tax credit. In addition, they had $54,000 of federal taxes withheld from their wages. Required: What is the Conner's net tax due/(refunded) for 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts