Question: PLEASE SHOW ALL WORK/UNDERSTANDING THROUGH WORD, EXCEL, OR WRITTEN! TY! Problem 4 - Income Inclusions Verity Hamilton is 30 years old and single. She experienced

PLEASE SHOW ALL WORK/UNDERSTANDING THROUGH WORD, EXCEL, OR WRITTEN! TY!

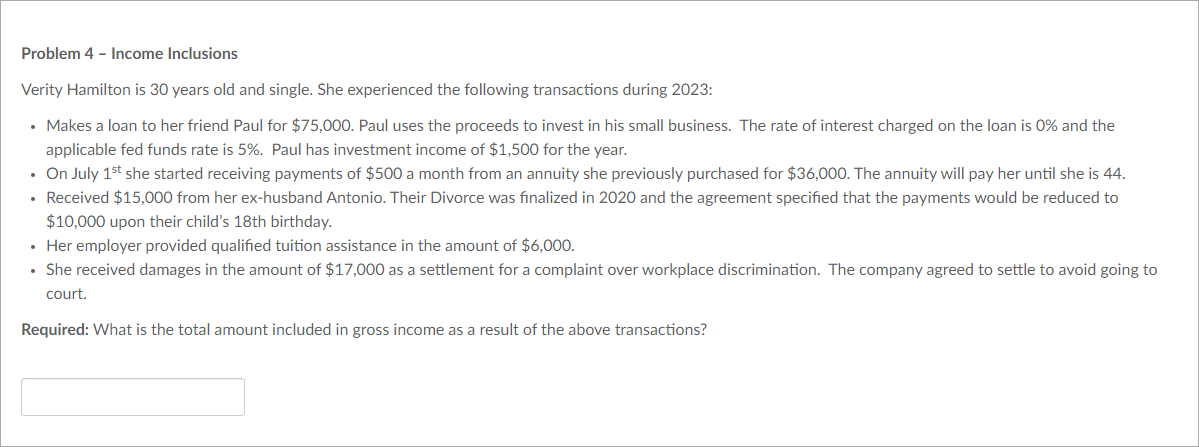

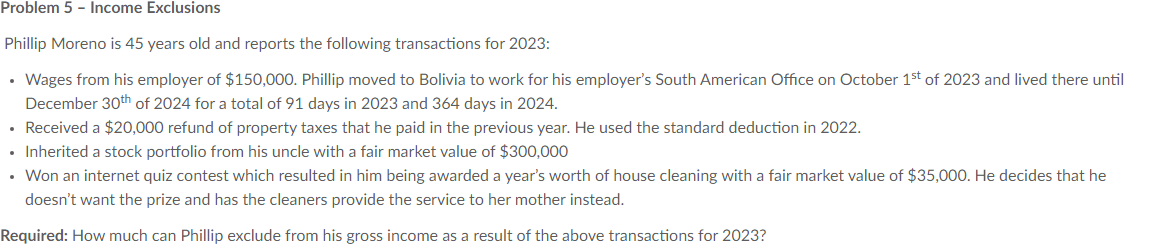

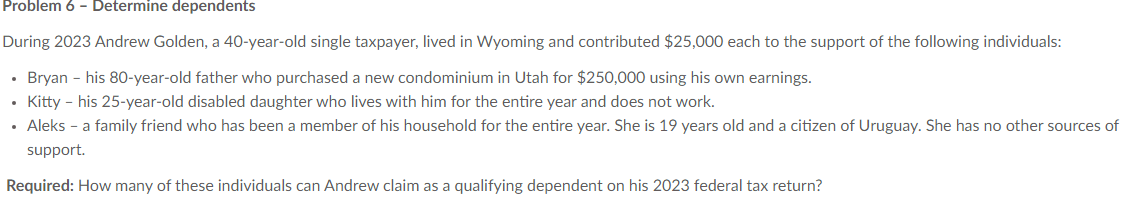

Problem 4 - Income Inclusions Verity Hamilton is 30 years old and single. She experienced the following transactions during 2023: - Makes a loan to her friend Paul for $75,000. Paul uses the proceeds to invest in his small business. The rate of interest charged on the loan is 0% and the applicable fed funds rate is 5%. Paul has investment income of $1,500 for the year. - On July 1st she started receiving payments of $500 a month from an annuity she previously purchased for $36,000. The annuity will pay her until she is 44 . - Received $15,000 from her ex-husband Antonio. Their Divorce was finalized in 2020 and the agreement specified that the payments would be reduced to $10,000 upon their child's 18 th birthday. - Her employer provided qualified tuition assistance in the amount of $6,000. - She received damages in the amount of $17,000 as a settlement for a complaint over workplace discrimination. The company agreed to settle to avoid going to court. Required: What is the total amount included in gross income as a result of the above transactions? Phillip Moreno is 45 years old and reports the following transactions for 2023: - Wages from his employer of $150,000. Phillip moved to Bolivia to work for his employer's South American Office on October 1st of 2023 and lived there until December 3th of 2024 for a total of 91 days in 2023 and 364 days in 2024. - Received a $20,000 refund of property taxes that he paid in the previous year. He used the standard deduction in 2022. - Inherited a stock portfolio from his uncle with a fair market value of $300,000 - Won an internet quiz contest which resulted in him being awarded a year's worth of house cleaning with a fair market value of $35,000. He decides that he doesn't want the prize and has the cleaners provide the service to her mother instead. equired: How much can Phillip exclude from his gross income as a result of the above transactions for 2023 ? During 2023 Andrew Golden, a 40-year-old single taxpayer, lived in Wyoming and contributed $25,000 each to the support of the following individuals: - Bryan - his 80-year-old father who purchased a new condominium in Utah for $250,000 using his own earnings. - Kitty - his 25-year-old disabled daughter who lives with him for the entire year and does not work. - Aleks - a family friend who has been a member of his household for the entire year. She is 19 years old and a citizen of Uruguay. She has no other sources of support. Required: How many of these individuals can Andrew claim as a qualifying dependent on his 2023 federal tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts