Question: please show all work for the upvote!! 28) Consider two risky stocks, A and B. Stock A has risk of 25% and has historically given

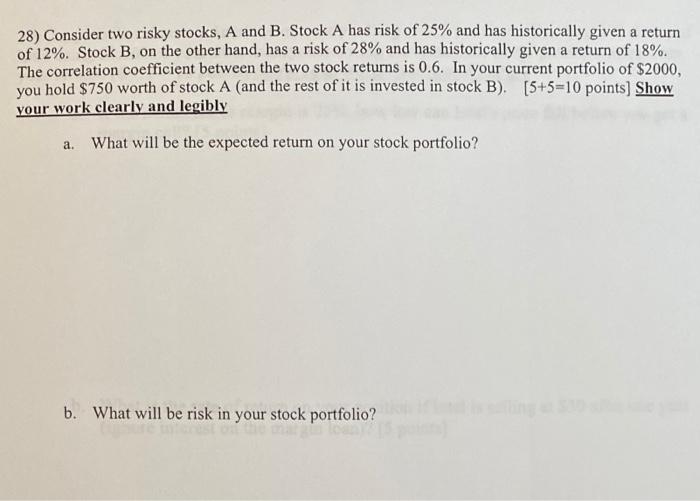

28) Consider two risky stocks, A and B. Stock A has risk of 25% and has historically given a return of 12%. Stock B, on the other hand, has a risk of 28% and has historically given a return of 18%. The correlation coefficient between the two stock returns is 0.6. In your current portfolio of $2000, you hold $750 worth of stock A (and the rest of it is invested in stock B). [5+5=10 points] Show your work clearly and legibly a. What will be the expected return on your stock portfolio? b. What will be risk in your stock portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts