Question: Please show all work in excel format. Upton Umbrellas has a cost of equity of 11.9 percent, the YTM on the company's bonds is 6.4

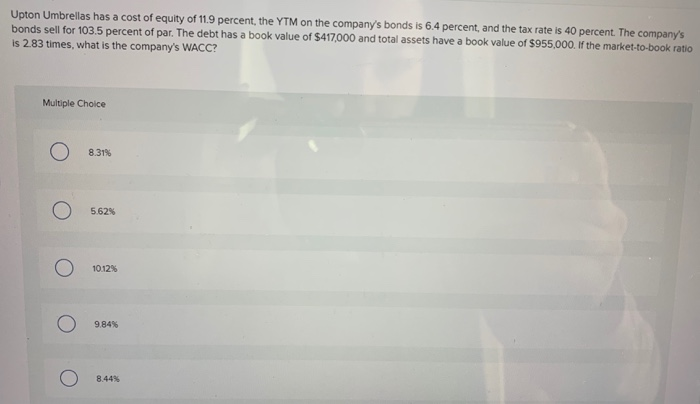

Upton Umbrellas has a cost of equity of 11.9 percent, the YTM on the company's bonds is 6.4 percent, and the tax rate is 40 percent. The company's bonds sell for 103.5 percent of par. The debt has a book value of $417,000 and total assets have a book value of $955,000. If the market-to-book ratio is 2.83 times, what is the company's WACC? Multiple Choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts