Question: please show all work in excel - In the first draft of the project, you should select a firm! Make certain that you have access

please show all work in excel

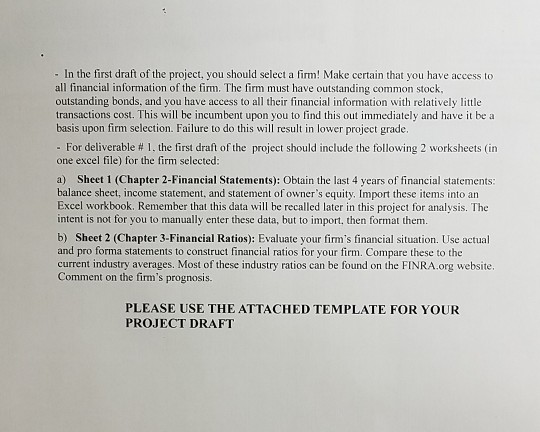

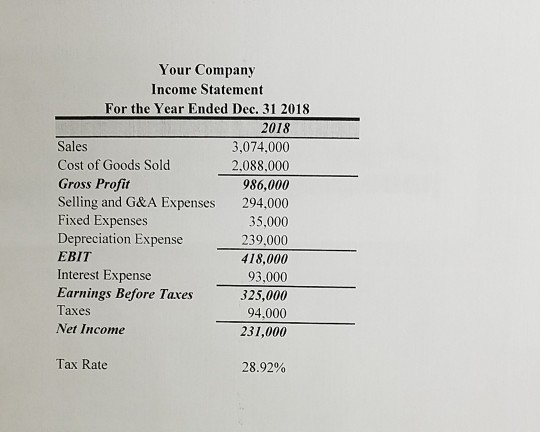

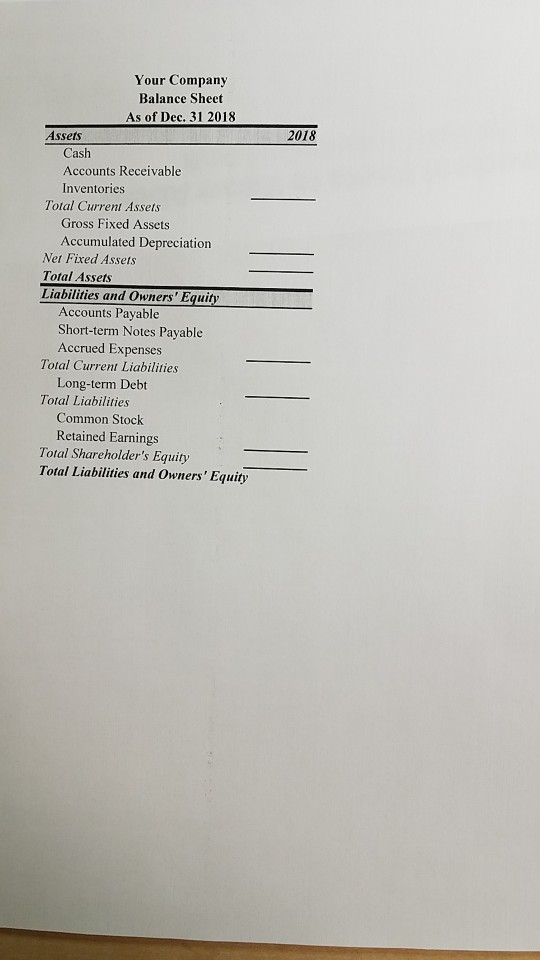

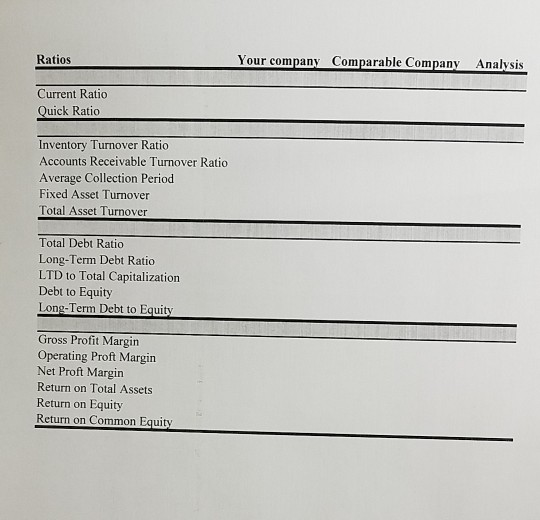

- In the first draft of the project, you should select a firm! Make certain that you have access to all financial information of the firm. The firm must have outstanding common stock outstanding bonds, and you have access to all their financial information with relatively little transactions cost. This will be incumbent upon you to find this out immediately and have it be a basis upon firm selection. Failure to do this will result in lower project grade. . For deliverable # 1. the first draft of the project should include the following 2 worksheets (in one excel file) for the firm selected: a) Sheet 1 (Chapter 2-Financial Statements): Obtain the last 4 years of financial statements balance sheet, income statement, and statement of owner's equity. Import these items into an Excel workbook. Remember that this data will be recalled later in this project for analysis. The intent is not for you to manually enter these data, but to import, then format them. b) Sheet 2 (Chapter 3-Financial Ratios): Evaluate your firm's financial situation. Use actual and pro forma statements to construct financial ratios for your firm. Compare these to the current industry averages. Most of these industry ratios can be found on the FINRA.org website, Comment on the firm's prognosis. PLEASE USE THE ATTACHED TEMPLATE FOR YOUR PROJECT DRAFT Your Company Income Statement For the Year Ended Dec. 31 2018 2018 Sales 3,074,000 Cost of Goods Sold 2,088,000 Gross Profit 986,000 Selling and G&A Expenses 294.000 Fixed Expenses 35,000 Depreciation Expense 239,000 EBIT 418,000 Interest Expense 93,000 Earnings Before Taxes 325,000 94,000 Net Income 231,000 Taxes Tax Rate 28.92% 2018 Your Company Balance Sheet As of Dec. 31 2018 Assets Cash Accounts Receivable Inventories Total Current Assets Gross Fixed Assets Accumulated Depreciation Ner Fixed Assets Total Assets Liabilities and Owners' Equity Accounts Payable Short-term Notes Payable Accrued Expenses Total Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Earnings Total Shareholder's Equity Total Liabilities and Owners' Equity Ratios Your company Comparable Company Analysis Current Ratio Quick Ratio Inventory Turnover Ratio Accounts Receivable Tumover Ratio Average Collection Period Fixed Asset Turnover Total Asset Turnover Total Debt Ratio Long-Term Debt Ratio LTD to Total Capitalization Debt to Equity Long-Term Debt to Equity Gross Profit Margin Operating Proft Margin Net Proft Margin Return on Total Assets Return on Equity Return on Common Equity - In the first draft of the project, you should select a firm! Make certain that you have access to all financial information of the firm. The firm must have outstanding common stock outstanding bonds, and you have access to all their financial information with relatively little transactions cost. This will be incumbent upon you to find this out immediately and have it be a basis upon firm selection. Failure to do this will result in lower project grade. . For deliverable # 1. the first draft of the project should include the following 2 worksheets (in one excel file) for the firm selected: a) Sheet 1 (Chapter 2-Financial Statements): Obtain the last 4 years of financial statements balance sheet, income statement, and statement of owner's equity. Import these items into an Excel workbook. Remember that this data will be recalled later in this project for analysis. The intent is not for you to manually enter these data, but to import, then format them. b) Sheet 2 (Chapter 3-Financial Ratios): Evaluate your firm's financial situation. Use actual and pro forma statements to construct financial ratios for your firm. Compare these to the current industry averages. Most of these industry ratios can be found on the FINRA.org website, Comment on the firm's prognosis. PLEASE USE THE ATTACHED TEMPLATE FOR YOUR PROJECT DRAFT Your Company Income Statement For the Year Ended Dec. 31 2018 2018 Sales 3,074,000 Cost of Goods Sold 2,088,000 Gross Profit 986,000 Selling and G&A Expenses 294.000 Fixed Expenses 35,000 Depreciation Expense 239,000 EBIT 418,000 Interest Expense 93,000 Earnings Before Taxes 325,000 94,000 Net Income 231,000 Taxes Tax Rate 28.92% 2018 Your Company Balance Sheet As of Dec. 31 2018 Assets Cash Accounts Receivable Inventories Total Current Assets Gross Fixed Assets Accumulated Depreciation Ner Fixed Assets Total Assets Liabilities and Owners' Equity Accounts Payable Short-term Notes Payable Accrued Expenses Total Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Earnings Total Shareholder's Equity Total Liabilities and Owners' Equity Ratios Your company Comparable Company Analysis Current Ratio Quick Ratio Inventory Turnover Ratio Accounts Receivable Tumover Ratio Average Collection Period Fixed Asset Turnover Total Asset Turnover Total Debt Ratio Long-Term Debt Ratio LTD to Total Capitalization Debt to Equity Long-Term Debt to Equity Gross Profit Margin Operating Proft Margin Net Proft Margin Return on Total Assets Return on Equity Return on Common Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts