Question: please show all work in excel, need help especially with part b ! very confused, 2. A $1,000 par value T-Note with 10 years to

please show all work in excel, need help especially with part b ! very confused,

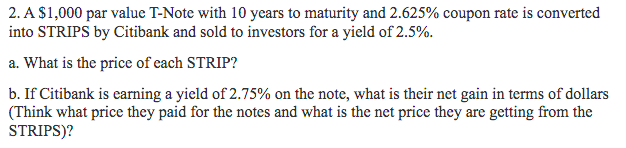

2. A $1,000 par value T-Note with 10 years to maturity and 2.625% coupon rate is converted into STRIPS by Citibank and sold to investors for a yield of 2.5%. a. What is the price of each STRIP? b. If Citibank is earning a yield of 2.75% on the note, what is their net gain in terms of dollars (Think what price they paid for the notes and what is the net price they are getting from the STRIPS)? 2. A $1,000 par value T-Note with 10 years to maturity and 2.625% coupon rate is converted into STRIPS by Citibank and sold to investors for a yield of 2.5%. a. What is the price of each STRIP? b. If Citibank is earning a yield of 2.75% on the note, what is their net gain in terms of dollars (Think what price they paid for the notes and what is the net price they are getting from the STRIPS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts