Question: The below involves my one question, which is based on 3 examples, it is not 3 separate questions. Please do not delete/close as below only

The below involves my one question, which is based on 3 examples, it is not 3 separate questions.

Please do not delete/close as below only involves only one question using 3 examples to get to my point.

All of the solutions are correct answers.

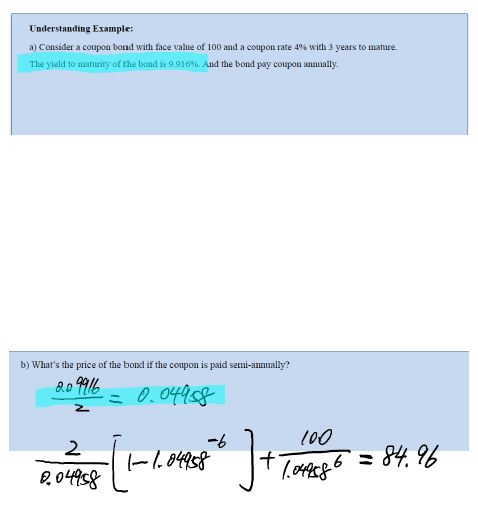

Example 1 below:

We are using YTM/2 as the rate here.

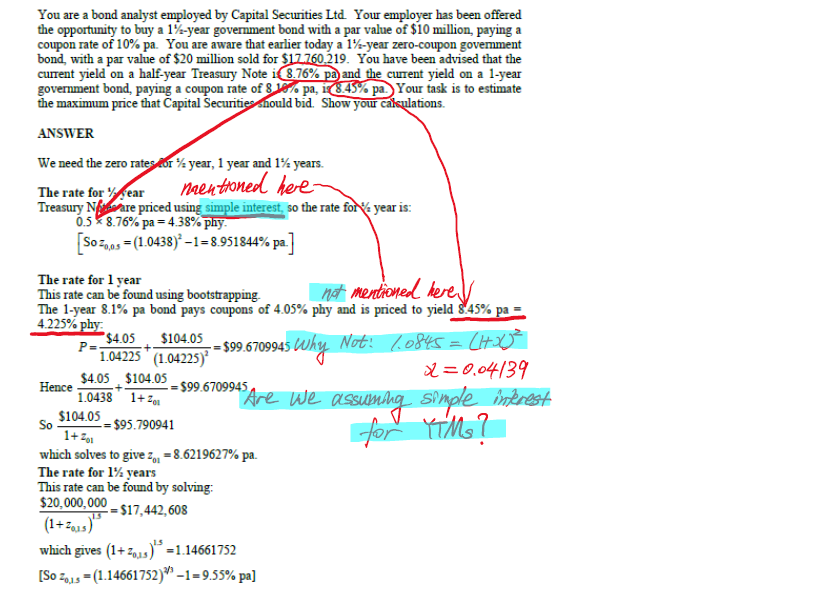

Example 2 below:

We are using YTM/2 = 0.0845/2 as the rate here.

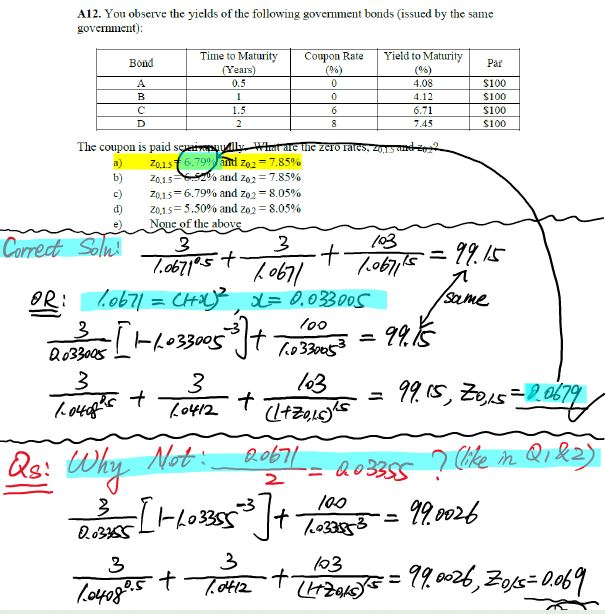

Example 3 below:

But here, we are using (1.0671^0.5) - 1 as the rate.

My Question is:

All three are paying semi-annual coupons, but why are Examples 1 & 2 using YTM/2, while Example 3 is using ((1+YTM)^0.5) - 1 as the rate ?

Thanks for your kind help.

Understanding Example: a) Consider a coupon bond with face value of 100 and a coupon rate 4% with 3 years to mature. The yield to manurity of the bond is 9.916%. And the bond pay coupon annually. b) What's the price of the bond if the coupon is paid semi-annually? 8.0 9916 = 0.04958 100 2 0.04958 -6 11.04958 J+ 7 It Togg = 84.96 You are a bond analyst employed by Capital Securities Ltd Your employer has been offered the opportunity to buy a 1%-year government bond with a par value of $10 million, paying a coupon rate of 10% pa. You are aware that earlier today a 1%-year zero-coupon govemment bond with a par value of $20 million sold for $17.760.219. You have been advised that the current yield on a half-year Treasury Note i 8.76% pa) and the current yield on a 1-year government bond, paying a coupon rate of 8 w pa, i 8.45% pa. Your task is to estimate the maximum price that Capital Securities should bid. Show your calculations. ANSWER We need the zero rates for 4 year, 1 year and 14 years. The rate for year maentioned here Treasury Nassare priced using simple interest, so the rate for year is: 0.58.76% pa = 4.38% phy. [S0 2,05 = (1.0438)* 1= 8.951844% pa] The rate for 1 year This rate can be found using bootstrapping not mentioned here The 1-year 8.1% pa bond pays coupons of 4.05% phy and is priced to yield $45% pa 4.225% phy: P= $4.05 $104.05 1.04225 (1.04225) x=0.04139 Hence $4.05 $104.05 $99.6709945 1.0438 1+2 $104.05 = $95.790941 1+201 which solves to give Zo. = 8.6219627% pa. The rate for 1% years This rate can be found by solving: 89.6709945 Why Not: 60845 = (HXD* simple interest for YTM ? As Are We assuming $20,000,000 - $17,442,608 (1+2015) which gives (1+2015) = 1.14661752 [So Zous =(1.14661752)" 1=9.55% pa] D A12. You observe the yields of the following goveniment bonds (issued by the same government): Bond Time to Maturity Coupon Rate Yield to Maturity (Years) (9) Par (9) A 0.5 0 4.08 $100 B 1 0 4.12 $100 C 1.5 6 6.71 $100 2 8 7.45 $100 The coupon is paid scary Wat are the zero rates, zons and a) 2015 6.799 and 20:2 = 7.85% b) 2015 and 202 = 7.85% 20.15-6.79% and zo2 = 8.05% d) 20.1.5=5.50% and 202 = 8.05% None of the above 3 3 + 7.067,15 3 2033005 100 52330053 Correct Soln! 7.067105t 99.15 1067/ OR: 1.0671 = CH3)2, x= 0.03005 same 0330095*3+ 99.15 3 3 103 1.0412 + (L+Zolo's Not: 0067/ [1-40335*3+ 99.0026 1033553 3 + 1040gos (47791046 = 99.0026, Zoys=0.069 Togglst 99.15, 20,5 = 2.0679 Qs: Why 2 003355? like in Q , &2) 100 4 3 2.3755 S 3 103 t T0412

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts