Question: Please show all work on paper or show excel formulas correct answer is marked with an X to help The follow questions are problems worth

Please show all work on paper or show excel formulas correct answer is marked with an X to help

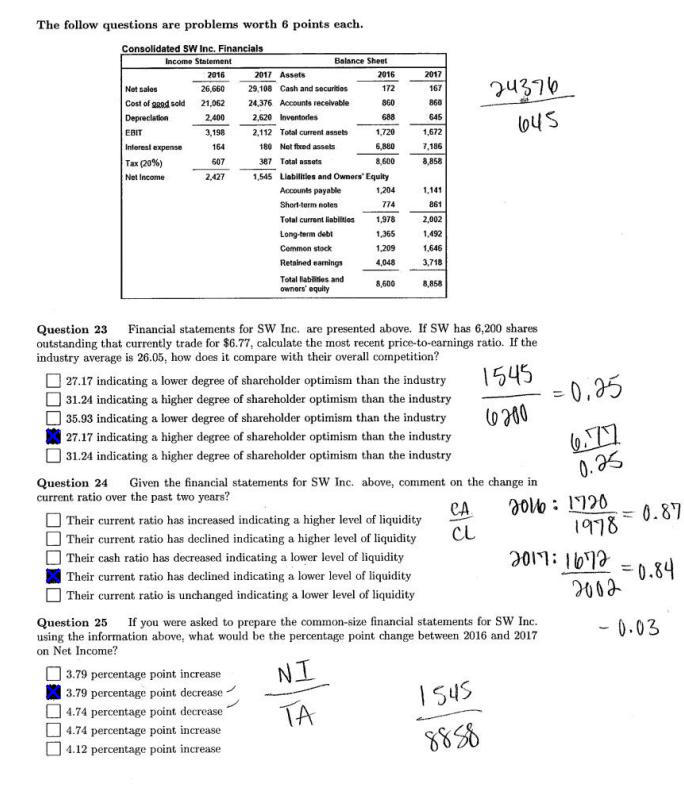

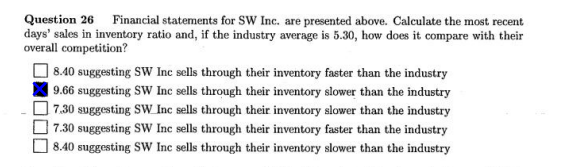

The follow questions are problems worth 6 points each. 2660 24376 6045 Consolidated SW Inc. Financials Income Statement Balance Sheet 2016 2017 Assets Net sales 29,108 Cash and securities Cost of sold 21,052 24,376 Accounts receivable Depreciation 2.620 Inventades 2,112 Total current assets Interest expense 180 Netfases Tw20%) 387 Total Net Income 1.545 Liabilities and Owners' Equity Accounts payable 1.204 Short-term noles Total current liabilities 1.978 Long-term debt 1.365 Common stock 1.209 Retained earnings 4,048 Total Bates and owners' equity 8.500 8,858 Question 23 Financial statements for SW Inc. are presented above. If SW has 6,200 shares outstanding that currently trade for $6.77, calculate the most recent price-to-earnings ratio. If the industry average is 26.05, how does it compare with their overall competition? 27.17 indicating a lower degree of shareholder optimism than the industry 31.24 indicating a higher degree of shareholder optimism than the industry 35.93 indicating a lower degree of shareholder optimism than the industry 27.17 indicating a higher degree of shareholder optimism than the industry 31.24 indicating a higher degree of shareholder optimism than the industry n the industry 1545 -= 0.25 (0200 - 0.25 DV6: 1720 1978 = 0.87 2002 -0.84 Question 24 Given the financial statements for SW Inc. above, comment on the change in current ratio over the past two years? Their current ratio has increased indicating a higher level of liquidity Their current ratio has declined indicating a higher level of liquidity el of liquidity CL Their cash ratio has decreased indicating a lower level of liquidity 2017:1672 - Their current ratio has declined indicating a lower level of liquidity Their current ratio is unchanged indicating a lower level of liquidity Question 25 If you were asked to prepare the common-size financial statements for SW Inc. -0.03 using the information above, what would be the percentage point change between 2016 and 2017 on Net Income? 3.79 percentage point increase NT 3.79 percentage point decrease 4.74 percentage point decrease TA 4.74 percentage point increase 4.12 percentage point increase 1545 8858 Question 26 Financial statements for SW Inc. are presented above. Calculate the most recent days' sales in inventory ratio and, if the industry average is 5.30, how does it compare with their overall competition? 8.40 suggesting SW Inc sells through their inventory faster than the industry 9.66 suggesting SW Inc sells through their inventory slower than the industry 7.30 suggesting SW Inc sells through their inventory slower than the industry 7.30 suggesting SW Inc sells through their inventory faster than the industry 8.40 suggesting SW Inc sells through their inventory slower than the industry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts