Question: Please show all work on paper or show excel formulas correct answer is marked with an X to help Question 32 Bowlafruit is looking to

Please show all work on paper or show excel formulas correct answer is marked with an X to help

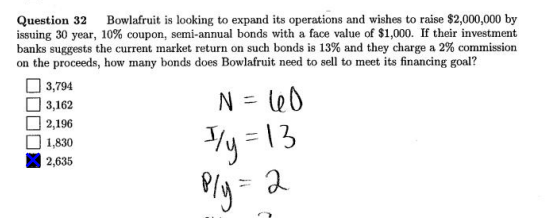

Question 32 Bowlafruit is looking to expand its operations and wishes to raise $2,000,000 by issuing 30 year, 10% coupon, semi-annual bonds with a face value of $1,000. If their investment banks suggests the current market return on such bonds is 13% and they charge a 2% commission on the proceeds, how many bonds does Bowlafruit need to sell to meet its financing goal? 3,794 3,162 2,196 1,830 2,635 N = 60 P/s = \ 3 Ply = 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts