Question: Please show all work. PROBLEM 4(9 MARKS) It was anticipated First Industries Incorporated would pay a cash dividend this year, as mentioned in Problem 3.

Please show all work.

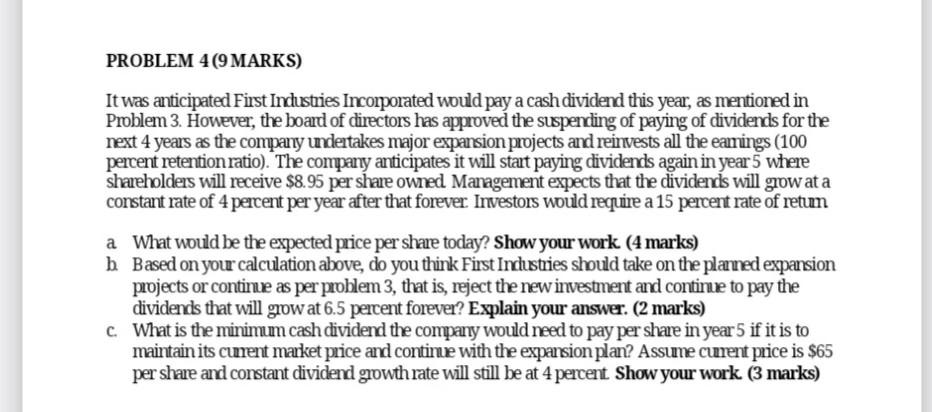

PROBLEM 4(9 MARKS) It was anticipated First Industries Incorporated would pay a cash dividend this year, as mentioned in Problem 3. However, the board of directors has approved the suspending of paying of dividends for the next 4 years as the company undertakes major expansion projects and reinvests all the eamings (100 percent retention ratio). The company anticipates it will start paying dividends again in year 5 where Shareholders will receive $8.95 per share owned Management expects that the dividends will giwat a constant rate of 4 percent per year after that forever Investors would require a 15 percent rate of return a What would be the expected price per share today? Show your work (4 marks) b Based on your calculation above, do you think First Industries should take on the planned expansion projects or continue as per problem 3, that is, reject the new investment and continue to pay the dividends that will grow at 6.5 percent forever? Explain your answer. (2 marks) c. What is the minimm cash dividend the company would need to pay per share in year 5 if it is to maintain its cument market price and continue with the expansion plan? Assume cument price is $65 per share and constant dividend growth rate will still be at 4 percent Show your work (3 marks) PROBLEM 4(9 MARKS) It was anticipated First Industries Incorporated would pay a cash dividend this year, as mentioned in Problem 3. However, the board of directors has approved the suspending of paying of dividends for the next 4 years as the company undertakes major expansion projects and reinvests all the eamings (100 percent retention ratio). The company anticipates it will start paying dividends again in year 5 where Shareholders will receive $8.95 per share owned Management expects that the dividends will giwat a constant rate of 4 percent per year after that forever Investors would require a 15 percent rate of return a What would be the expected price per share today? Show your work (4 marks) b Based on your calculation above, do you think First Industries should take on the planned expansion projects or continue as per problem 3, that is, reject the new investment and continue to pay the dividends that will grow at 6.5 percent forever? Explain your answer. (2 marks) c. What is the minimm cash dividend the company would need to pay per share in year 5 if it is to maintain its cument market price and continue with the expansion plan? Assume cument price is $65 per share and constant dividend growth rate will still be at 4 percent Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts