Question: please show all work Question 3 (14 marks) On July 2, 2020, Paddy Ltd. purchased $500,000, 8% bonds of Yolanda Ltd. for $545,000. (note: no

please show all work

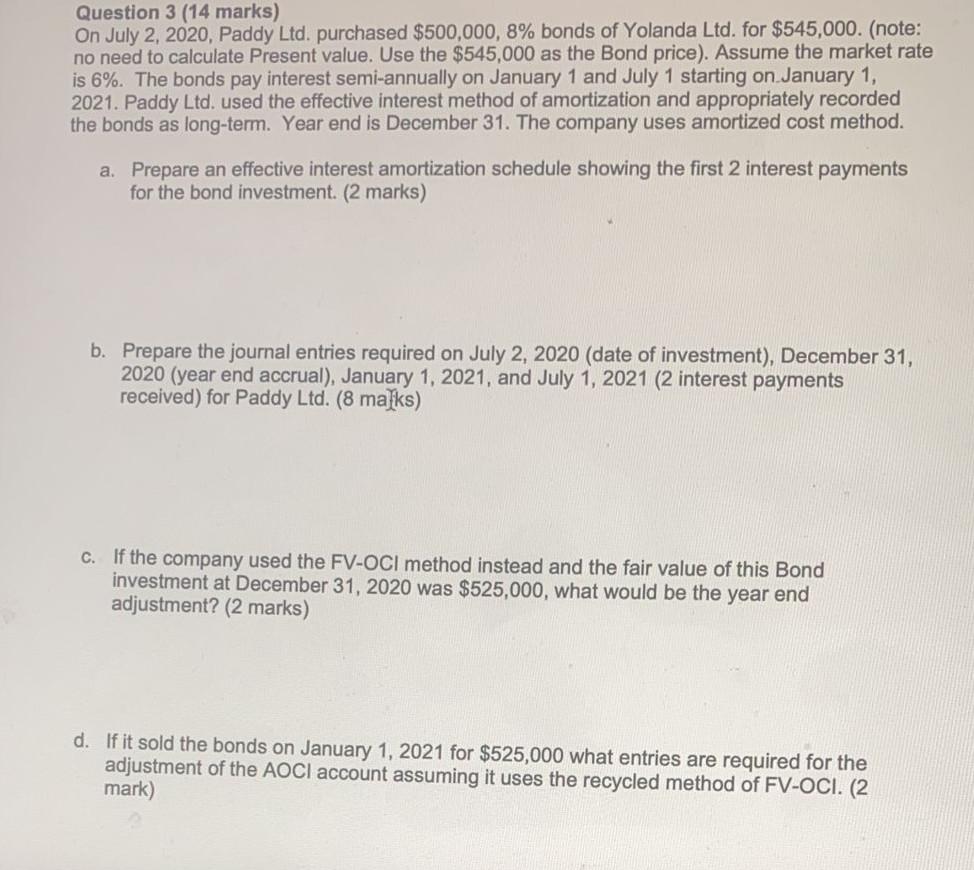

Question 3 (14 marks) On July 2, 2020, Paddy Ltd. purchased $500,000, 8% bonds of Yolanda Ltd. for $545,000. (note: no need to calculate Present value. Use the $545,000 as the Bond price). Assume the market rate is 6%. The bonds pay interest semi-annually on January 1 and July 1 starting on January 1, 2021. Paddy Ltd. used the effective interest method of amortization and appropriately recorded the bonds as long-term. Year end is December 31. The company uses amortized cost method. a. Prepare an effective interest amortization schedule showing the first 2 interest payments for the bond investment. (2 marks) b. Prepare the journal entries required on July 2, 2020 (date of investment), December 31, 2020 (year end accrual), January 1, 2021, and July 1, 2021 (2 interest payments received) for Paddy Ltd. (8 malks) C. If the company used the FV-OCI method instead and the fair value of this Bond investment at December 31, 2020 was $525,000, what would be the year end adjustment? (2 marks) d. If it sold the bonds on January 1, 2021 for $525,000 what entries are required for the adjustment of the AOCI account assuming it uses the recycled method of FV-OCI. (2 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts