Question: please show all work so i can understand how you came to the answer QUESTION 13 Use table B to Calculate Zero Rates for maturities

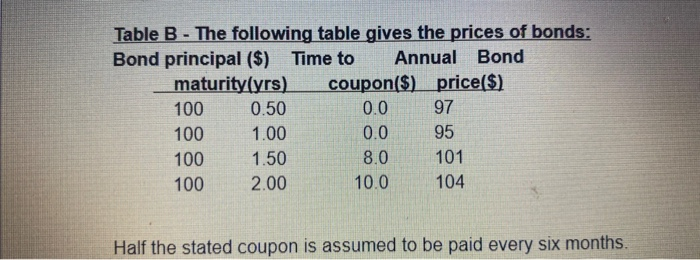

QUESTION 13 Use table B to Calculate Zero Rates for maturities of 6 months. 12 months and 18 months (1.5yrs). Note the annual coupon is paid semiannually! (Hint: As shown in classif $97 present value will give you $100 in 6 months with continuous compounding what is the zero rate? Do that for the ones you can and then substitute your answers to solve for the one with the coupons) Notice this question is worth 20 points. T T T Arial 3 (12pt) T- i Words: Path:p Table B - The following table gives the prices of bonds: Bond principal ($) Time to Annual Bond maturity(yrs) coupon($) price($) 100 0.50 0.0 97 100 1.00 0. 0 95 100 1.50 8.0 101 100 2.00 10.0 104 Half the stated coupon is assumed to be paid every six months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts