Question: please show all work with 4 decimal points on calculator and steps using a BA II plus finance calculator 11. You going to purchase a

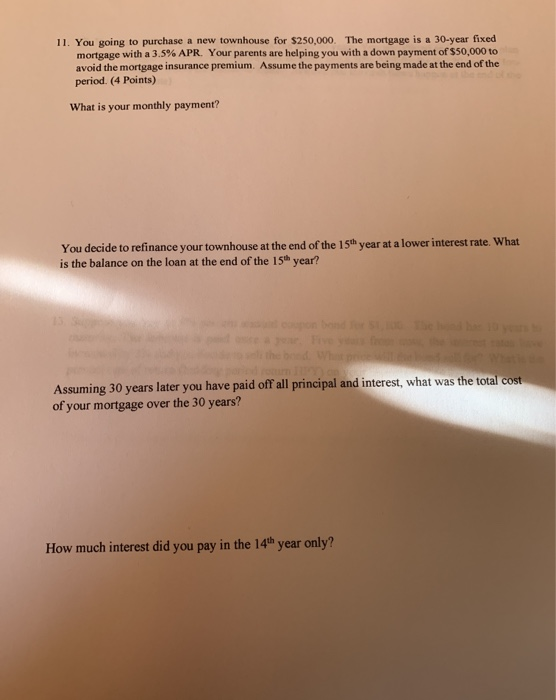

11. You going to purchase a new townhouse for $250,000. The mortgage is a 30-year fixed mortgage with a 3.5% APR. Your parents are helping you with a down payment of $50,000 to avoid the mortgage insurance premium. Assume the payments are being made at the end of the period. (4 Points) What is your monthly payment? You decide to refinance your townhouse at the end of the 15th year at a lower interest rate. What is the balance on the loan at the end of the 15th year? Assuming 30 years later you have paid off all principal and interest, what was the total cost of your mortgage over the 30 years? How much interest did you pay in the 14th year only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts