Question: PLEASE show all work without excel, thank you very much upvotes will be given!! 5. You were hrred as a consultant to Quigley Company, whose

PLEASE show all work without excel, thank you very much upvotes will be given!!

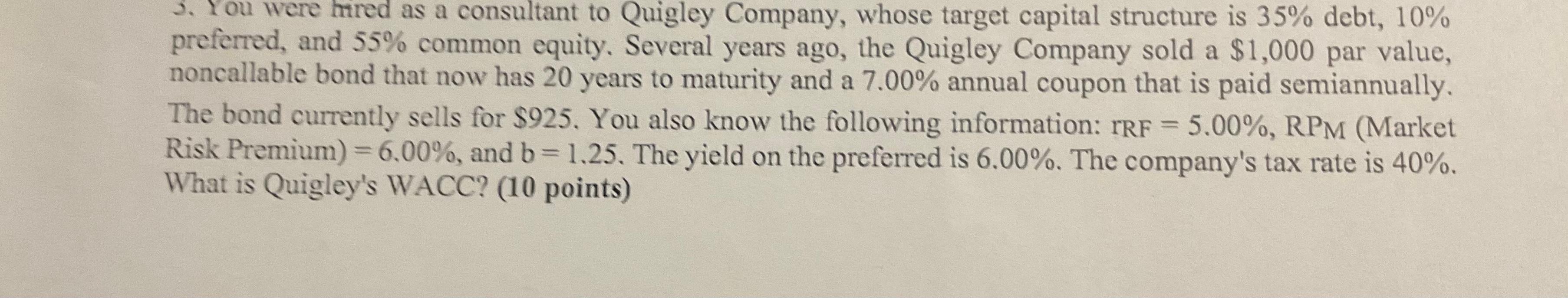

5. You were hrred as a consultant to Quigley Company, whose target capital structure is 35% debt, 10% preferred, and 55% common equity. Several years ago, the Quigley Company sold a $1,000 par value, noncallable bond that now has 20 years to maturity and a 7.00% annual coupon that is paid semiannually. The bond currently sells for $925. You also know the following information: rRF =5.00%, RPM (Market Risk Premium )=6.00%, and b=1.25. The yield on the preferred is 6.00%. The company's tax rate is 40%. What is Quigley's WACC? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts