Question: please show all working a) Martin & Sons (M&S) currently is an all equity firm with 40,000 shares of stock outstanding at a market price

please show all working

please show all working

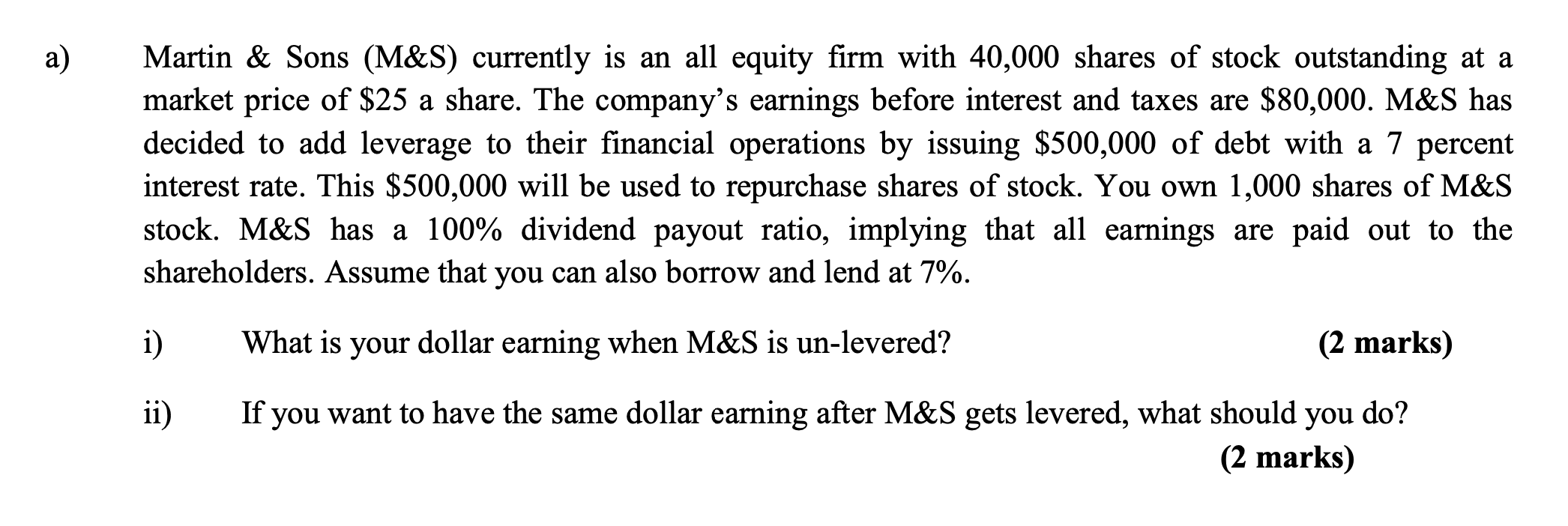

a) Martin & Sons (M&S) currently is an all equity firm with 40,000 shares of stock outstanding at a market price of $25 a share. The company's earnings before interest and taxes are $80,000. M&S has decided to add leverage to their financial operations by issuing $500,000 of debt with a 7 percent interest rate. This $500,000 will be used to repurchase shares of stock. You own 1,000 shares of M&S stock. M&S has a 100% dividend payout ratio, implying that all earnings are paid out to the shareholders. Assume that you can also borrow and lend at 7%. i) What is your dollar earning when M&S is un-levered? (2 marks) ii) If you want to have the same dollar earning after M&S gets levered, what should you do? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts