Question: please show all working Question 2 - Total 8 marks a) RBL Investment Company Limited is selling a one-year call option contract on it's stock

please show all working

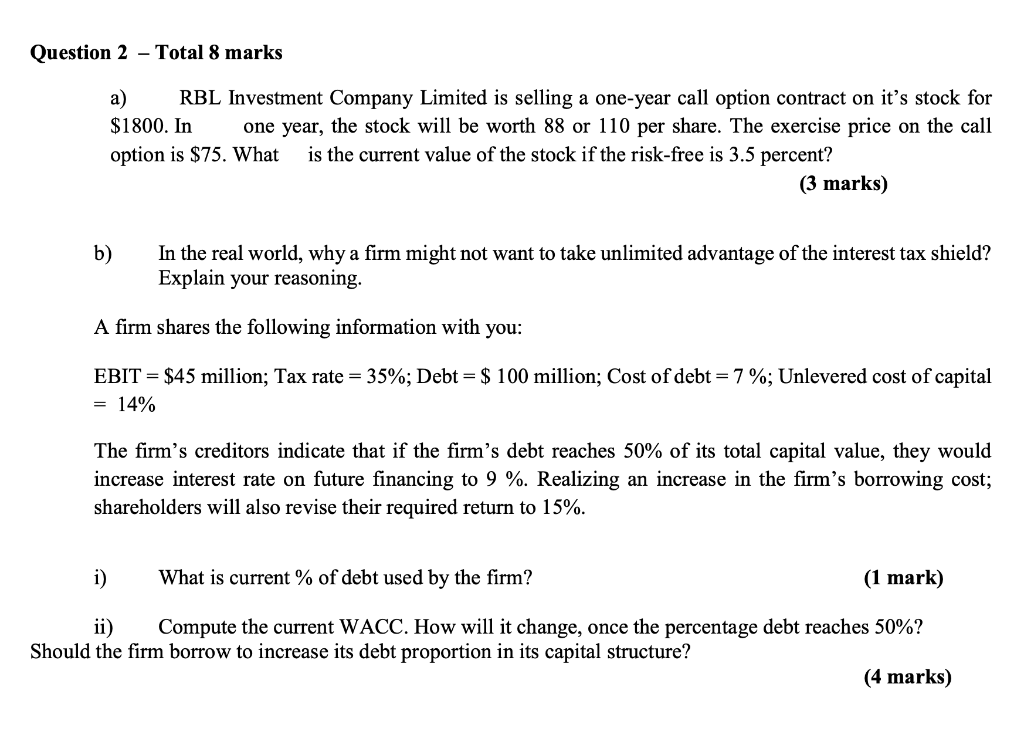

Question 2 - Total 8 marks a) RBL Investment Company Limited is selling a one-year call option contract on it's stock for $1800. In one year, the stock will be worth 88 or 110 per share. The exercise price on the call option is $75. What is the current value of the stock if the risk-free is 3.5 percent? (3 marks) b) In the real world, why a firm might not want to take unlimited advantage of the interest tax shield? Explain your reasoning. A firm shares the following information with you: EBIT = $45 million; Tax rate = 35%; Debt = $ 100 million; Cost of debt = 7 %; Unlevered cost of capital = 14% The firm's creditors indicate that if the firm's debt reaches 50% of its total capital value, they would increase interest rate on future financing to 9 %. Realizing an increase in the firm's borrowing cost; shareholders will also revise their required return to 15%. i) What is current % of debt used by the firm? (1 mark) ii) Compute the current WACC. How will it change, once the percentage debt reaches 50%? Should the firm borrow to increase its debt proportion in its capital structure? marks) Question 2 - Total 8 marks a) RBL Investment Company Limited is selling a one-year call option contract on it's stock for $1800. In one year, the stock will be worth 88 or 110 per share. The exercise price on the call option is $75. What is the current value of the stock if the risk-free is 3.5 percent? (3 marks) b) In the real world, why a firm might not want to take unlimited advantage of the interest tax shield? Explain your reasoning. A firm shares the following information with you: EBIT = $45 million; Tax rate = 35%; Debt = $ 100 million; Cost of debt = 7 %; Unlevered cost of capital = 14% The firm's creditors indicate that if the firm's debt reaches 50% of its total capital value, they would increase interest rate on future financing to 9 %. Realizing an increase in the firm's borrowing cost; shareholders will also revise their required return to 15%. i) What is current % of debt used by the firm? (1 mark) ii) Compute the current WACC. How will it change, once the percentage debt reaches 50%? Should the firm borrow to increase its debt proportion in its capital structure? marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts