Question: Please show all your work and formulas extended out as much as possible and then simplified. Explain and defend your answer of why McAleer should

Please show all your work and formulas extended out as much as possible and then simplified.

Explain and defend your answer of why McAleer should or should not invest.

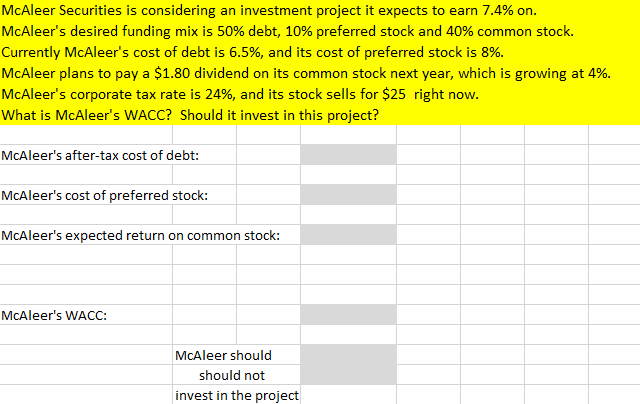

McAleer Securities is considering an investment project it expects to earn 7.4% on McAleer's desired funding mix is 50% debt, 10% preferred stock and 40% common stock. Currently McAleer's cost of debt is 6.5%, and its cost of preferred stock is 896. McAleer plans to pay a $1.80 dividend on its common stock next year, which is growing at 4% McAleer's corporate tax rate is 24%, and its stock sells for $25 right now. What is McAleer's WACC? Should it invest in this project? McAleer's after-tax cost of debt: McAleer's cost of preferred stock: McAleer's expected return on common stock: McAleer's WACC: McAleer should should not invest in the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts