Question: Please show all your work on how you got the answers, Thank you! Will upvote. 2. (SHOW YOUR COMPLETE WORK) A manufacturer is considering three

Please show all your work on how you got the answers, Thank you! Will upvote.

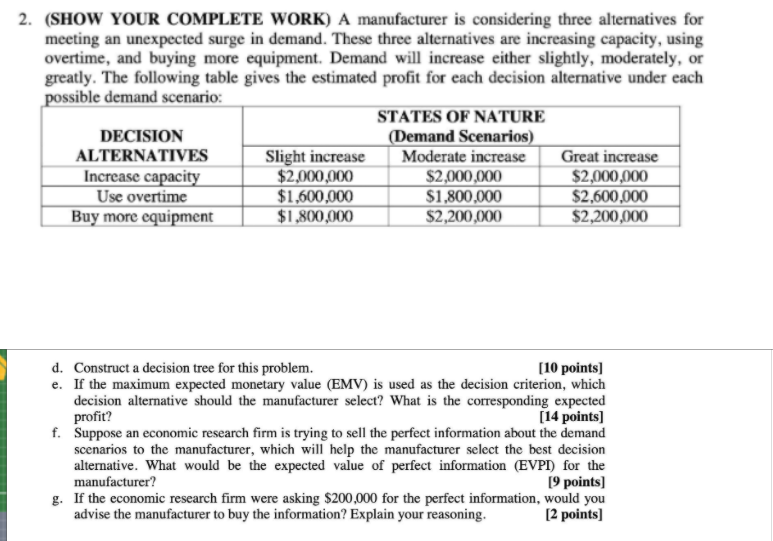

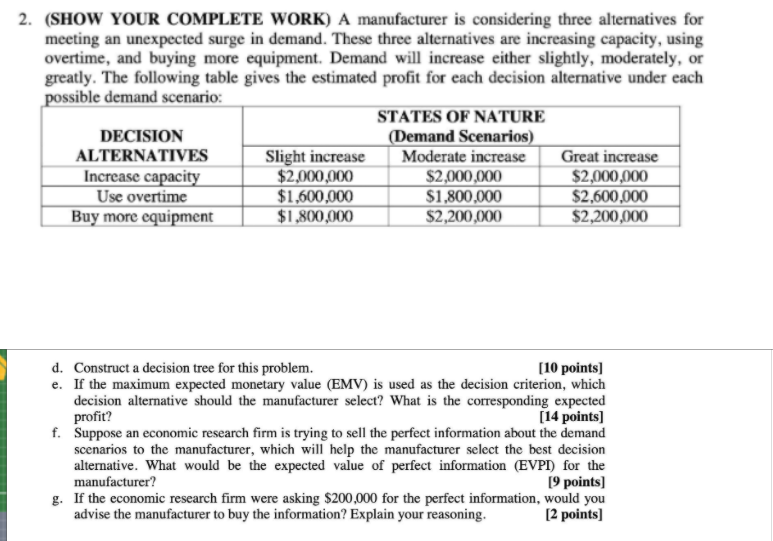

2. (SHOW YOUR COMPLETE WORK) A manufacturer is considering three alternatives for meeting an unexpected surge in demand. These three alternatives are increasing capacity, using overtime, and buying more equipment. Demand will increase either slightly, moderately, or greatly. The following table gives the estimated profit for each decision alternative under each possible demand scenario: STATES OF NATURE DECISION (Demand Scenarios) ALTERNATIVES Slight increase Moderate increase Great increase Increase capacity $2,000,000 $2,000,000 $2,000,000 Use overtime $1,600,000 $1,800,000 $2,600,000 Buy more equipment $1,800,000 $2,200,000 $2,200,000 d. Construct a decision tree for this problem. [10 points) e. If the maximum expected monetary value (EMV) is used as the decision criterion, which decision alternative should the manufacturer select? What is the corresponding expected profit? [14 points) f. Suppose an economic research firm is trying to sell the perfect information about the demand scenarios to the manufacturer, which will help the manufacturer select the best decision alternative. What would be the expected value of perfect information (EVPI) for the manufacturer? [9 points) g. If the economic research firm were asking $200,000 for the perfect information, would you advise the manufacturer to buy the information? Explain your reasoning. [2 points) 2. (SHOW YOUR COMPLETE WORK) A manufacturer is considering three alternatives for meeting an unexpected surge in demand. These three alternatives are increasing capacity, using overtime, and buying more equipment. Demand will increase either slightly, moderately, or greatly. The following table gives the estimated profit for each decision alternative under each possible demand scenario: STATES OF NATURE DECISION (Demand Scenarios) ALTERNATIVES Slight increase Moderate increase Great increase Increase capacity $2,000,000 $2,000,000 $2,000,000 Use overtime $1,600,000 $1,800,000 $2,600,000 Buy more equipment $1,800,000 $2,200,000 $2,200,000 d. Construct a decision tree for this problem. [10 points) e. If the maximum expected monetary value (EMV) is used as the decision criterion, which decision alternative should the manufacturer select? What is the corresponding expected profit? [14 points) f. Suppose an economic research firm is trying to sell the perfect information about the demand scenarios to the manufacturer, which will help the manufacturer select the best decision alternative. What would be the expected value of perfect information (EVPI) for the manufacturer? [9 points) g. If the economic research firm were asking $200,000 for the perfect information, would you advise the manufacturer to buy the information? Explain your reasoning. [2 points)