Question: Please show below step by step via Excel calculations: Q4: Currency Swap Value On September 15th, 2013, ABC bank entered into a 2-year currency swap

Please show below step by step via Excel calculations:

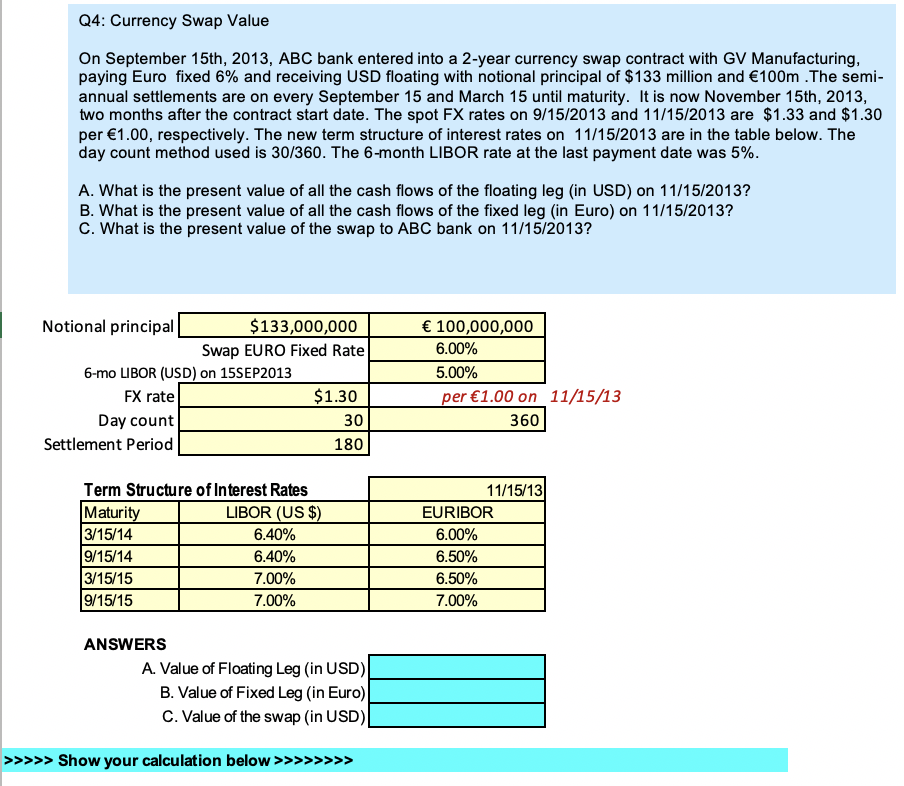

Q4: Currency Swap Value On September 15th, 2013, ABC bank entered into a 2-year currency swap contract with GV Manufacturing, paying Euro fixed 6% and receiving USD floating with notional principal of $133 million and 100m The semi annual settlements are on every September 15 and March 15 until maturity. It is now November 15th, 2013, two months after the contract start date. The spot FX rates on 9/15/2013 and 11/15/2013 are $1.33 and $1.30 per1.00, respectively. The new term structure of interest rates on 11/15/2013 are in the table below. The day count method used is 30/360. The 6-month LIBOR rate at the last payment date was 5% A. What is the present value of all the cash flows of the floating leg (in USD) on 11/15/2013? B. What is the present value of all the cash flows of the fixed leg (in Euro) on 11/15/2013? C. What is the present value of the swap to ABC bank on 11/15/2013? Notional principal 100,000,000 $133,000,000 6.00% Swap EURO Fixed Rate 5.00% 6-mo LIBOR (USD) on 15SEP2013 $1.30 per 1.00 on 11/15/13 FX rate Day count 30 360 Settlement Period 180 11/15/13 Term Structure of Interest Rates Maturity 3/15/14 9/15/14 3/15/15 9/15/15 LIBOR (US $) EURIBOR 6.40% 6.00% 6.40% 6.50% 7.00% 6.50% 7.00% 7.00% ANSWERS A. Value of Floating Leg (in USD) B. Value of Fixed Leg (in Euro) C. Value of the swap (in USD) >>>>>Show your calculation below >>>>>> Q4: Currency Swap Value On September 15th, 2013, ABC bank entered into a 2-year currency swap contract with GV Manufacturing, paying Euro fixed 6% and receiving USD floating with notional principal of $133 million and 100m The semi annual settlements are on every September 15 and March 15 until maturity. It is now November 15th, 2013, two months after the contract start date. The spot FX rates on 9/15/2013 and 11/15/2013 are $1.33 and $1.30 per1.00, respectively. The new term structure of interest rates on 11/15/2013 are in the table below. The day count method used is 30/360. The 6-month LIBOR rate at the last payment date was 5% A. What is the present value of all the cash flows of the floating leg (in USD) on 11/15/2013? B. What is the present value of all the cash flows of the fixed leg (in Euro) on 11/15/2013? C. What is the present value of the swap to ABC bank on 11/15/2013? Notional principal 100,000,000 $133,000,000 6.00% Swap EURO Fixed Rate 5.00% 6-mo LIBOR (USD) on 15SEP2013 $1.30 per 1.00 on 11/15/13 FX rate Day count 30 360 Settlement Period 180 11/15/13 Term Structure of Interest Rates Maturity 3/15/14 9/15/14 3/15/15 9/15/15 LIBOR (US $) EURIBOR 6.40% 6.00% 6.40% 6.50% 7.00% 6.50% 7.00% 7.00% ANSWERS A. Value of Floating Leg (in USD) B. Value of Fixed Leg (in Euro) C. Value of the swap (in USD) >>>>>Show your calculation below >>>>>>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts