Question: please show calculations and excell spreadsheet. Question #5. TVM - Future Value & Payments Suppose you want to start saving on a monthly basis so

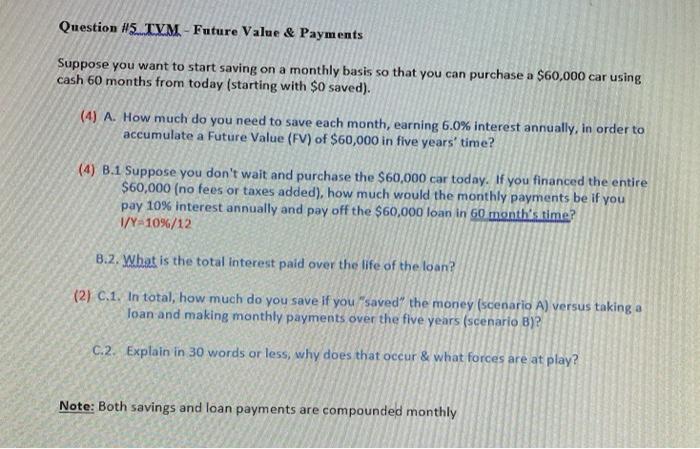

Question #5. TVM - Future Value & Payments Suppose you want to start saving on a monthly basis so that you can purchase a $60,000 car using cash 60 months from today (starting with $0 saved). (4) A. How much do you need to save each month, earning 6.0% interest annually, in order to accumulate a Future Value (FV) of $60,000 in five years' time? (4) B.1 Suppose you don't wait and purchase the $60,000 car today. If you financed the entire $60,000 (no fees or taxes added), how much would the monthly payments be if you pay 10% interest annually and pay off the $60,000 loan in GO month's time? 1/Y-10%/12 B.2. What is the total interest paid over the life of the loan? (2) C.1. In total, how much do you save if you "saved" the money (scenario A) versus taking a loan and making monthly payments over the five years (scenario B)? C.2. Explain in 30 words or less, why does that occur & what forces are at play? Note: Both savings and loan payments are compounded monthly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts