Question: Question #5 TVM - Future Value & Payments Suppose you want to start saving on a monthly basis so that you can purchase a $60,000

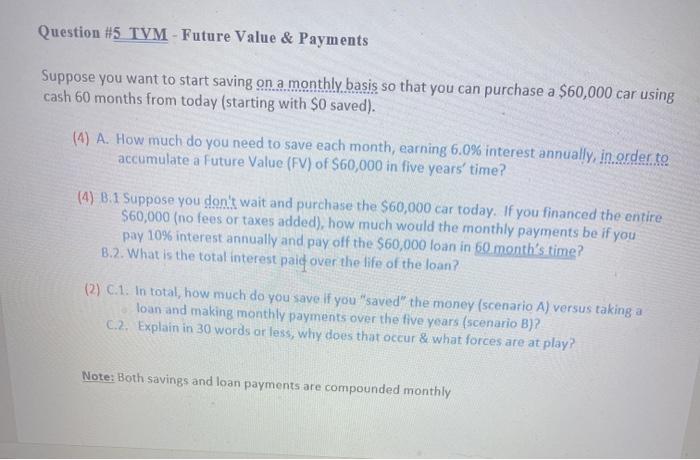

Question #5 TVM - Future Value & Payments Suppose you want to start saving on a monthly basis so that you can purchase a $60,000 car using cash 60 months from today (starting with $0 saved). (4) A. How much do you need to save each month, earning 6.0% interest annually, in order to accumulate a Future Value (FV) of $60,000 in five years' time? (4) B.1 Suppose you don't wait and purchase the $60,000 car today. If you financed the entire $60,000 (no fees or taxes added), how much would the monthly payments be if you pay 10% interest annually and pay off the $60,000 loan in 60 month's time? 3.2. What is the total interest paid over the life of the loan? (2) C.1. In total, how much do you save if you "saved" the money (scenario A) versus taking a loan and making monthly payments over the five years (scenario B)? C.2. Explain in 30 words or less, why does that occur & what forces are at play? Note: Both savings and loan payments are compounded monthly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts