Question: please show calculations that are NOT on excel. formulas, steps using financial calculator or written work are appreciated! 1) Abe Simpson's Historical Aircraft, Inc. (ASHAI)

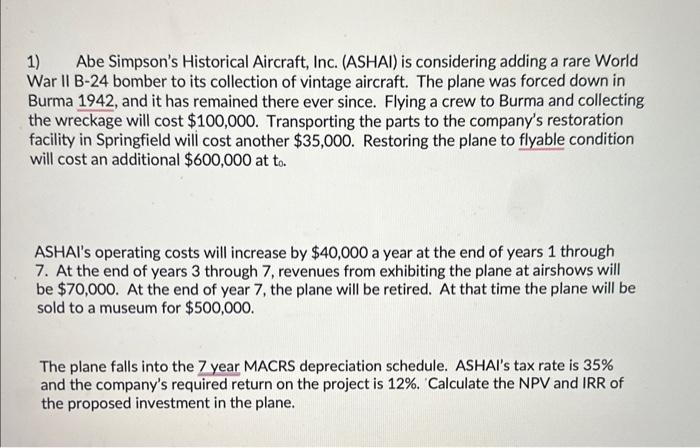

1) Abe Simpson's Historical Aircraft, Inc. (ASHAI) is considering adding a rare World War II B-24 bomber to its collection of vintage aircraft. The plane was forced down in Burma 1942 , and it has remained there ever since. Flying a crew to Burma and collecting the wreckage will cost $100,000. Transporting the parts to the company's restoration facility in Springfield will cost another $35,000. Restoring the plane to flyable condition will cost an additional $600,000 at t0. ASHAl's operating costs will increase by $40,000 a year at the end of years 1 through 7. At the end of years 3 through 7 , revenues from exhibiting the plane at airshows will be $70,000. At the end of year 7 , the plane will be retired. At that time the plane will be sold to a museum for $500,000. The plane falls into the 7 year MACRS depreciation schedule. ASHAl's tax rate is 35% and the company's required return on the project is 12%. 'Calculate the NPV and IRR of the proposed investment in the plane

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts