Question: Please show clear steps and do not use excel for the problem. Stan elects to receive his retirement benefit over 10 years. The first monthly

Please show clear steps and do not use excel for the problem.

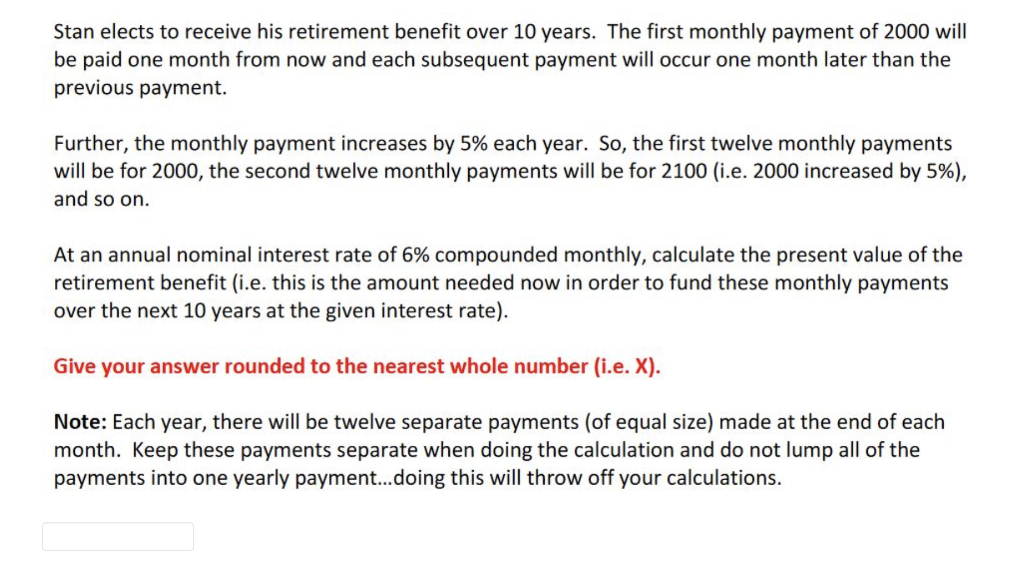

Stan elects to receive his retirement benefit over 10 years. The first monthly payment of 2000 will be paid one month from now and each subsequent payment will occur one month later than the previous payment. Further, the monthly payment increases by 5% each year. So, the first twelve monthly payments will be for 2000, the second twelve monthly payments will be for 2100 (i.e. 2000 increased by 5%), and so on. At an annual nominal interest rate of 6% compounded monthly, calculate the present value of the retirement benefit (i.e. this is the amount needed now in order to fund these monthly payments over the next 10 years at the given interest rate). Give your answer rounded to the nearest whole number (i.e. X). Note: Each year, there will be twelve separate payments (of equal size) made at the end of each month. Keep these payments separate when doing the calculation and do not lump all of the payments into one yearly payment...doing this will throw off your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts