Question: please show clear working... i will leave a thumbs up. Lively Inc manufactures a single product and is considering whether to use marginal or absorption

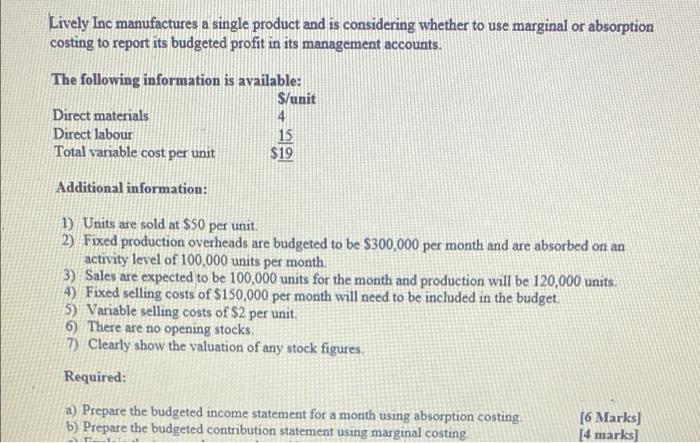

Lively Inc manufactures a single product and is considering whether to use marginal or absorption costing to report its budgeted profit in its management accounts. The following information is available: S/unit Direct materials 4 Direct labour 15 Total variable cost per unit $19 Additional information: 1) Units are sold at $50 per unit. 2) Fixed production overheads are budgeted to be $300,000 per month and are absorbed on an activity level of 100,000 units per month. 3) Sales are expected to be 100,000 units for the month and production will be 120,000 units. 4) Fixed selling costs of $150,000 per month will need to be included in the budget 5) Variable selling costs of $2 per unit. 6) There are no opening stocks. 7) Clearly show the valuation of any stock figures Required: a) Prepare the budgeted income statement for a month using absorption costing. [6 Marks] b) Prepare the budgeted contribution statement using marginal costing. [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts