Question: Please show clear working out for both question Question 1 5 pts Cassowary Media Ltd is an Australian company (resident for tax purposes) with an

Please show clear working out for both question

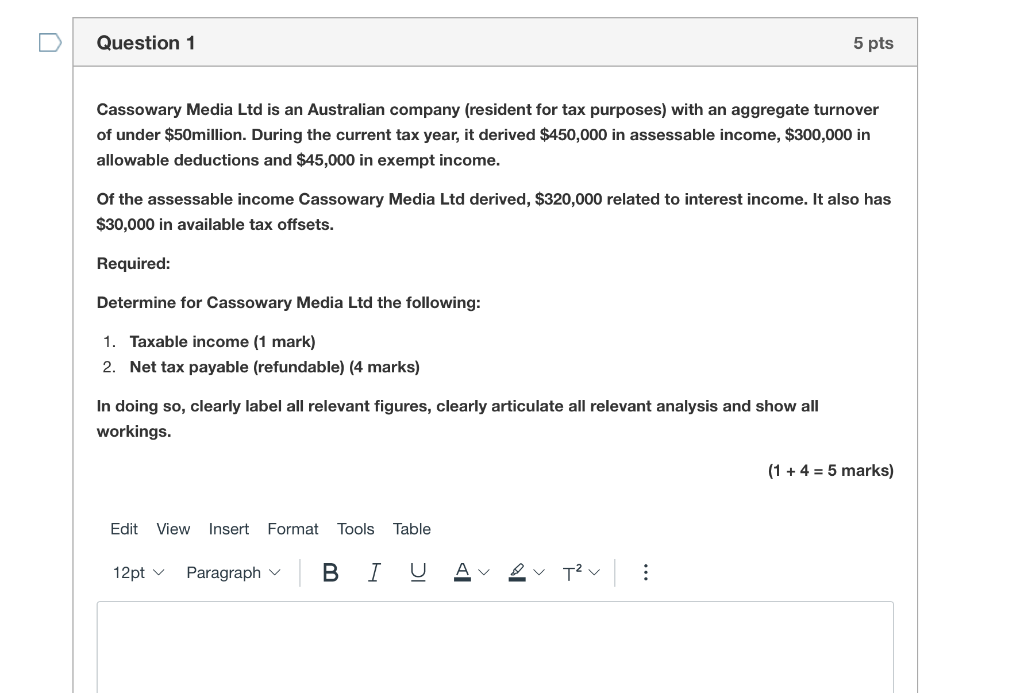

Question 1 5 pts Cassowary Media Ltd is an Australian company (resident for tax purposes) with an aggregate turnover of under $50million. During the current tax year, it derived $450,000 in assessable income, $300,000 in allowable deductions and $45,000 in exempt income. Of the assessable income Cassowary Media Ltd derived, $320,000 related to interest income. It also has $30,000 in available tax offsets. Required: Determine for Cassowary Media Ltd the following: 1. Taxable income (1 mark) 2. Net tax payable (refundable) (4 marks) In doing so, clearly label all relevant figures, clearly articulate all relevant analysis and show all workings. (1 + 4 = 5 marks) Edit View Insert Format Tools Table 12ptv Paragraph B I UI Tv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts