Question: PLEASE SHOW COMPLETE SOLUTIONS Use the following data for the next two (2) questions Cliff is a self-employed and professional accountant. He provided the following

PLEASE SHOW COMPLETE SOLUTIONS

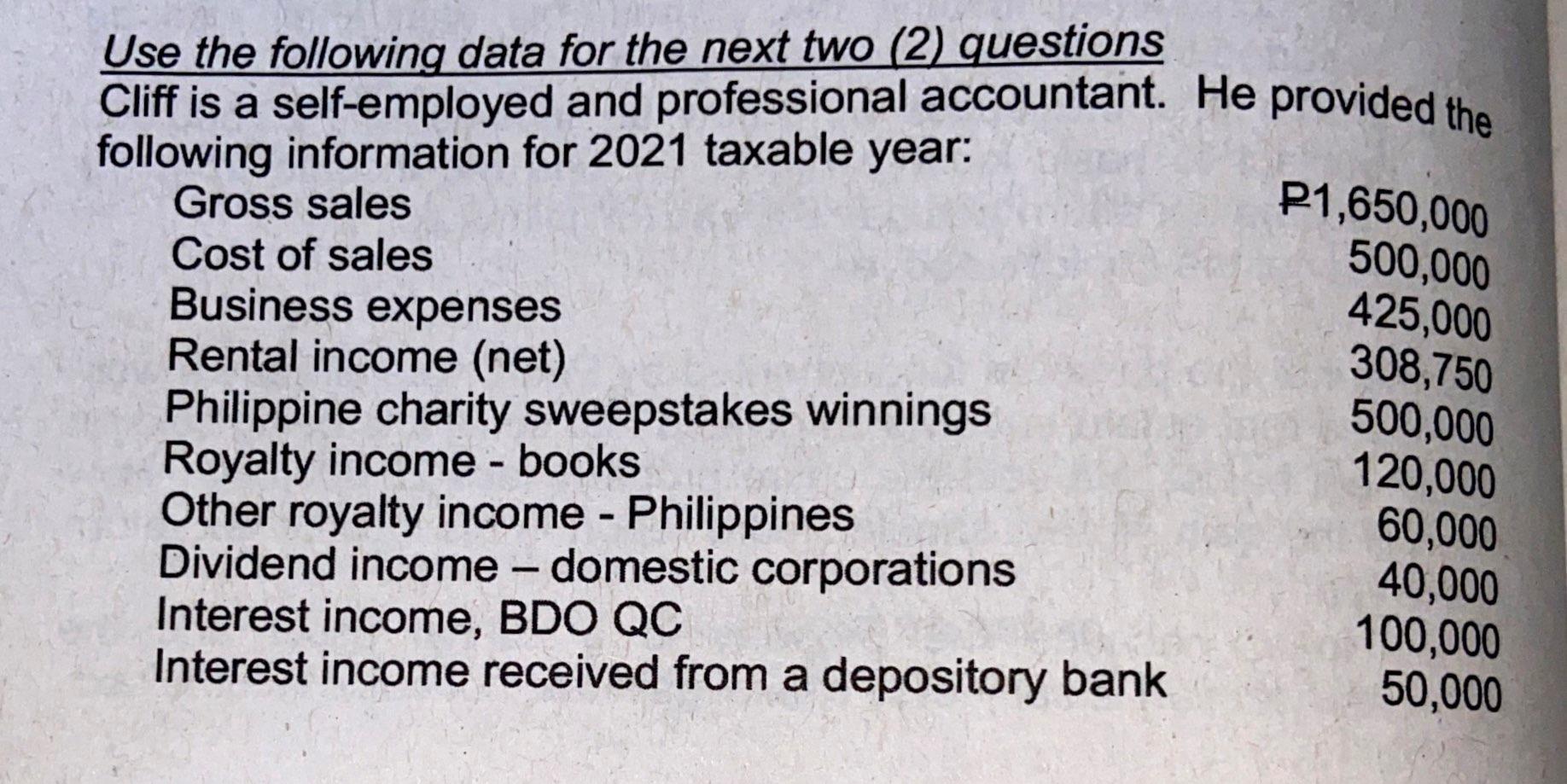

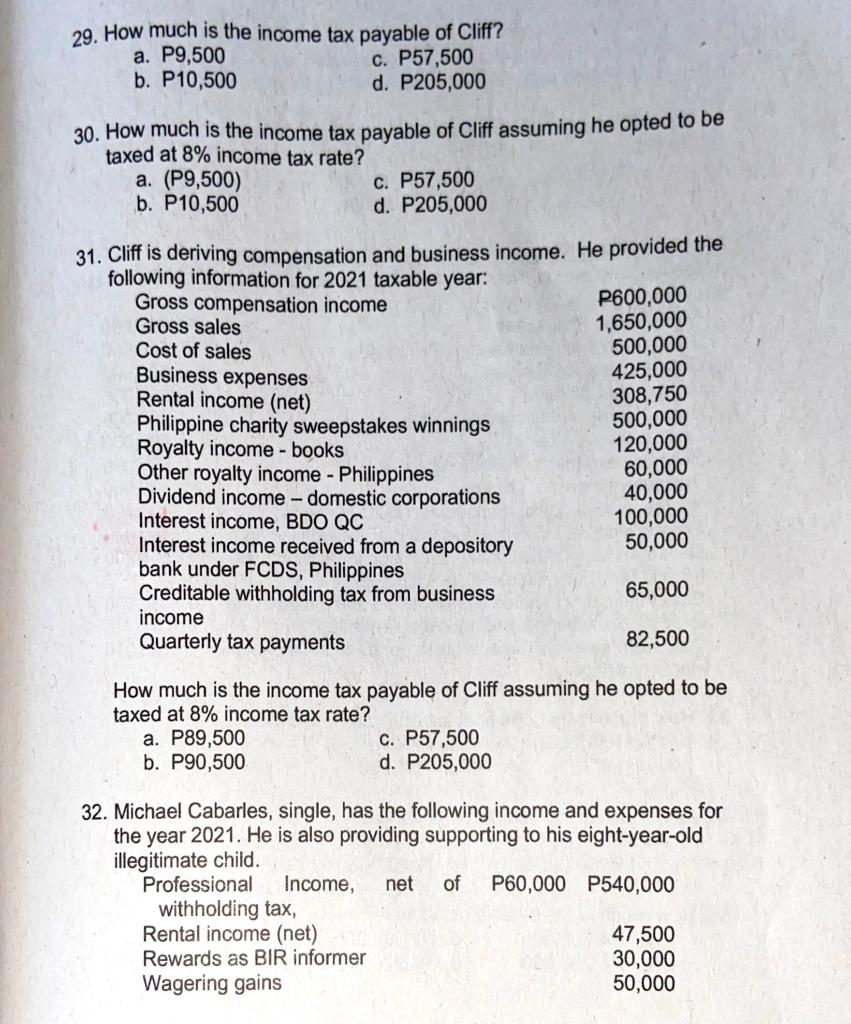

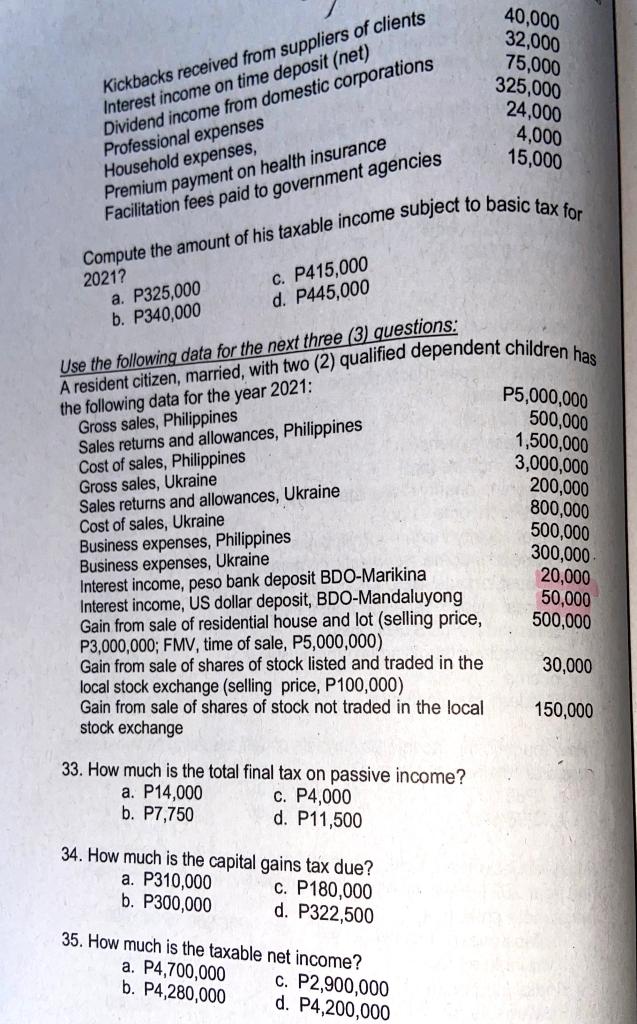

Use the following data for the next two (2) questions Cliff is a self-employed and professional accountant. He provided the following information for 2021 taxable year: GrosssalesCostofsalesBusinessexpensesRentalincome(net)PhilippinecharitysweepstakeswinningsRoyaltyincome-booksOtherroyaltyincome-PhilippinesDividendincome-domesticcorporationsInterestincome,BDOQCInterestincomereceivedfromadepositorybankP1,650,000500,000425,000308,750500,000120,00060,00040,000100,00050,000 29. How much is the income tax payable of Cliff? a. P9,500 c. P 57,500 b. P10,500 d. P205,000 30. How much is the income tax payable of Cliff assuming he opted to be taxed at 8% income tax rate? a. (P9,500) c. P 57,500 b. P10,500 d. P205,000 31 How much is the income tax payable of Cliff assuming he opted to be taxed at 8% income tax rate? a. P89,500 c. P 57,500 b. P90,500 d. P205,000 32. Michael Cabarles, single, has the following income and expenses for the year 2021. He is also providing supporting to his eight-year-old illonitimato rhild Compute the amount of his taxadie "I.. 2021 ? a. P 325,000 c. P415,000 b. P340,000 d. P445,000 IIse the following data for the next three (3) questions: 33. How much is the total final tax on passive income? a. P14,000 c. P4,000 b. P7,750 d. P11,500 34. How much is the capital gains tax due? a. P310,000 b. P300,000 c. P180,000 d. P322,500 35. How much is the taxable net income? a. P4,700,000 b. P4,280,000 c. P2,900,000 d. P4,200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts