Question: Please show each form. Tax Return Problem Norman and Leslie Beber are married and file a joint return for tax year 2021. They live at

Please show each form.

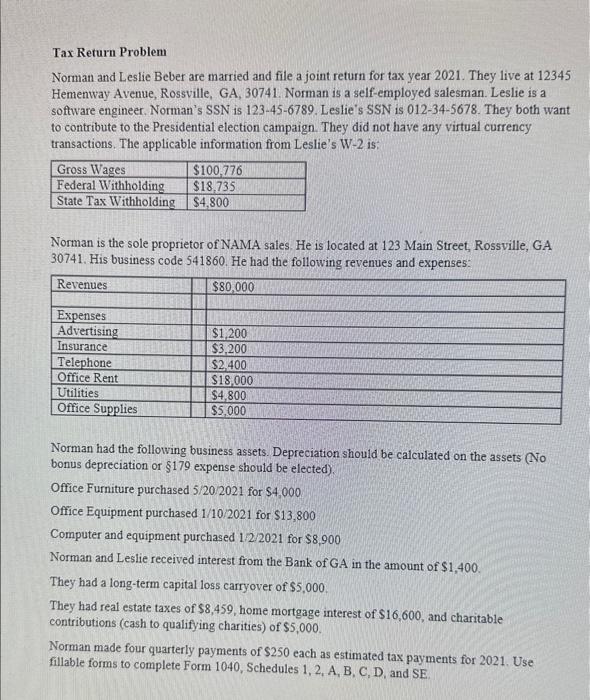

Tax Return Problem Norman and Leslie Beber are married and file a joint return for tax year 2021. They live at 12345 Hemenway Avenue, Rossville, GA, 30741. Norman is a self-employed salesman. Leslie is a software engineer. Norman's SSN is 123-45-6789. Leslie's SSN is 012-34-5678. They both want to contribute to the Presidential election campaign. They did not have any virtual currency transactions. The applicable information from Leslie's W-2 is: Norman is the sole proprietor of NAMA sales. He is located at 123 Main Street, Rossville, GA 30741. His business code 541860 . He had the following revenues and expenses: Norman had the following business assets. Depreciation should be calculated on the assets No bonus depreciation or $179 expense should be elected). Office Furniture purchased 5/20/2021 for $4,000 Office Equipment purchased 1/10/2021 for $13,800 Computer and equipment purchased 1/2/2021 for $8,900 Norman and Leslie received interest from the Bank of GA in the amount of $1,400. They had a long-term capital loss carryover of $5,000. They had real estate taxes of $8,459, home mortgage interest of $16,600, and charitable contributions (cash to qualifying charities) of $5,000. Norman made four quarterly payments of $250 each as estimated tax payments for 2021 . Use fillable forms to complete Form 1040, Schedules 1, 2, A, B, C, D, and SE. Tax Return Problem Norman and Leslie Beber are married and file a joint return for tax year 2021. They live at 12345 Hemenway Avenue, Rossville, GA, 30741. Norman is a self-employed salesman. Leslie is a software engineer. Norman's SSN is 123-45-6789. Leslie's SSN is 012-34-5678. They both want to contribute to the Presidential election campaign. They did not have any virtual currency transactions. The applicable information from Leslie's W-2 is: Norman is the sole proprietor of NAMA sales. He is located at 123 Main Street, Rossville, GA 30741. His business code 541860 . He had the following revenues and expenses: Norman had the following business assets. Depreciation should be calculated on the assets No bonus depreciation or $179 expense should be elected). Office Furniture purchased 5/20/2021 for $4,000 Office Equipment purchased 1/10/2021 for $13,800 Computer and equipment purchased 1/2/2021 for $8,900 Norman and Leslie received interest from the Bank of GA in the amount of $1,400. They had a long-term capital loss carryover of $5,000. They had real estate taxes of $8,459, home mortgage interest of $16,600, and charitable contributions (cash to qualifying charities) of $5,000. Norman made four quarterly payments of $250 each as estimated tax payments for 2021 . Use fillable forms to complete Form 1040, Schedules 1, 2, A, B, C, D, and SE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts