Question: Please show each working properly with an explanation for each step so that I understand 5. Mojo is considering investing in an outdoor equipment line.

Please show each working properly with an explanation for each step so that I understand

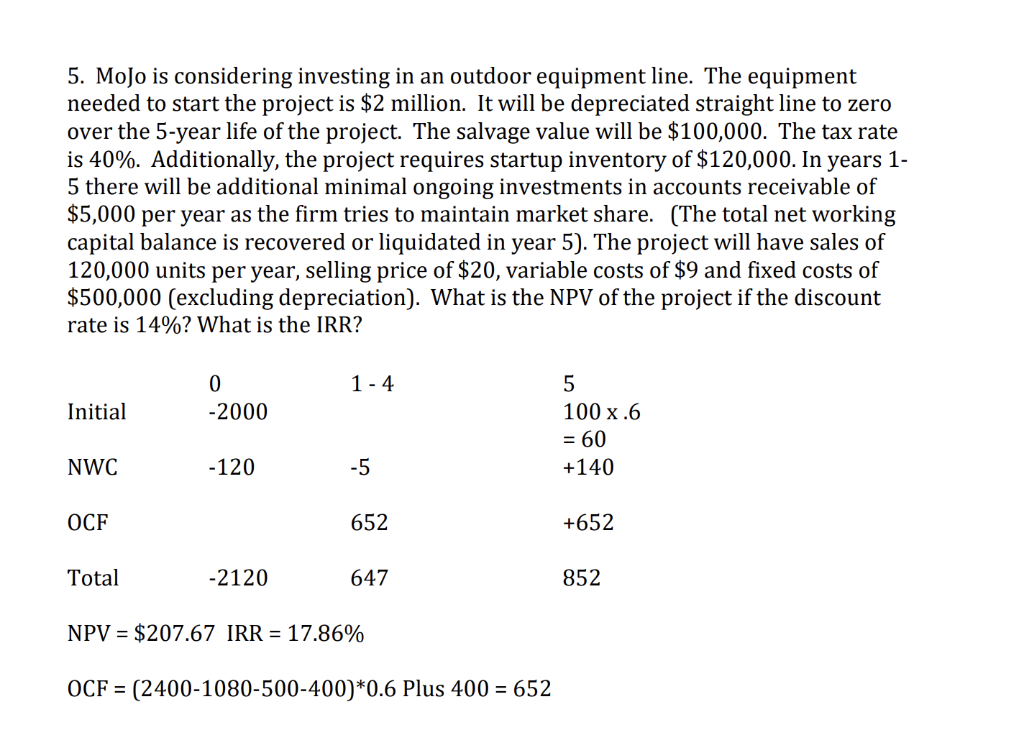

5. Mojo is considering investing in an outdoor equipment line. The equipment needed to start the project is $2 million. It will be depreciated straight line to zero over the 5-year life of the project. The salvage value will be $100,000. The tax rate is 40%. Additionally, the project requires startup inventory of $120,000. In years 1- 5 there will be additional minimal ongoing investments in accounts receivable of $5,000 per year as the firm tries to maintain market share. (The total net working capital balance is recovered or liquidated in year 5). The project will have sales of 120,000 units per year, selling price of $20, variable costs of $9 and fixed costs of $500,000 (excluding depreciation). What is the NPV of the project if the discount rate is 14%? What is the IRR? 1-4 0 -2000 Initial 5 100 x.6 = 60 +140 NWC - 120 -5 OCF 652 +652 Total -2120 647 852 NPV = $207.67 IRR = 17.86% OCF = (2400-1080-500-400)*0.6 Plus 400 = 652

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts