Question: Please show equation on excel too Instructions: Set up an excel spreadsheet to analyze each part of the assignment below. You may base your excel

Please show equation on excel too

Please show equation on excel too

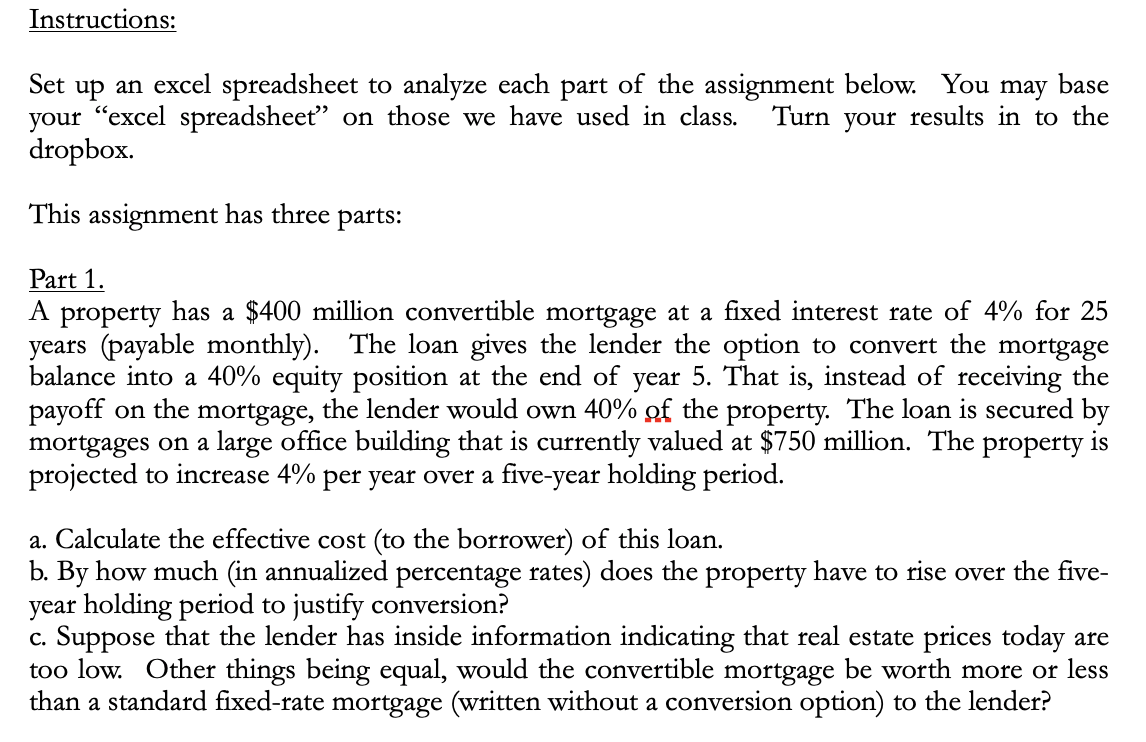

Instructions: Set up an excel spreadsheet to analyze each part of the assignment below. You may base your "excel spreadsheet on those we have used in class. Turn your results in to the dropbox. This assignment has three parts: Part 1. A property has a $400 million convertible mortgage at a fixed interest rate of 4% for 25 years (payable monthly). The loan gives the lender the option to convert the mortgage balance into a 40% equity position at the end of year 5. That is, instead of receiving the payoff on the mortgage, the lender would own 40% of the property. The loan is secured by mortgages on a large office building that is currently valued at $750 million. The property is projected to increase 4% per year over a five-year holding period. a. Calculate the effective cost (to the borrower) of this loan. b. By how much (in annualized percentage rates) does the property have to rise over the five- year holding period to justify conversion? c. Suppose that the lender has inside information indicating that real estate prices today are too low. Other things being equal, would the convertible mortgage be worth more or less than a standard fixed-rate mortgage (written without a conversion option) to the lender? Instructions: Set up an excel spreadsheet to analyze each part of the assignment below. You may base your "excel spreadsheet on those we have used in class. Turn your results in to the dropbox. This assignment has three parts: Part 1. A property has a $400 million convertible mortgage at a fixed interest rate of 4% for 25 years (payable monthly). The loan gives the lender the option to convert the mortgage balance into a 40% equity position at the end of year 5. That is, instead of receiving the payoff on the mortgage, the lender would own 40% of the property. The loan is secured by mortgages on a large office building that is currently valued at $750 million. The property is projected to increase 4% per year over a five-year holding period. a. Calculate the effective cost (to the borrower) of this loan. b. By how much (in annualized percentage rates) does the property have to rise over the five- year holding period to justify conversion? c. Suppose that the lender has inside information indicating that real estate prices today are too low. Other things being equal, would the convertible mortgage be worth more or less than a standard fixed-rate mortgage (written without a conversion option) to the lender

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts