Question: Please show equations on excel Instructions: Set up an excel spreadsheet to analyze each part of the assignment below. You may base your excel spreadsheet

Please show equations on excel

Please show equations on excel

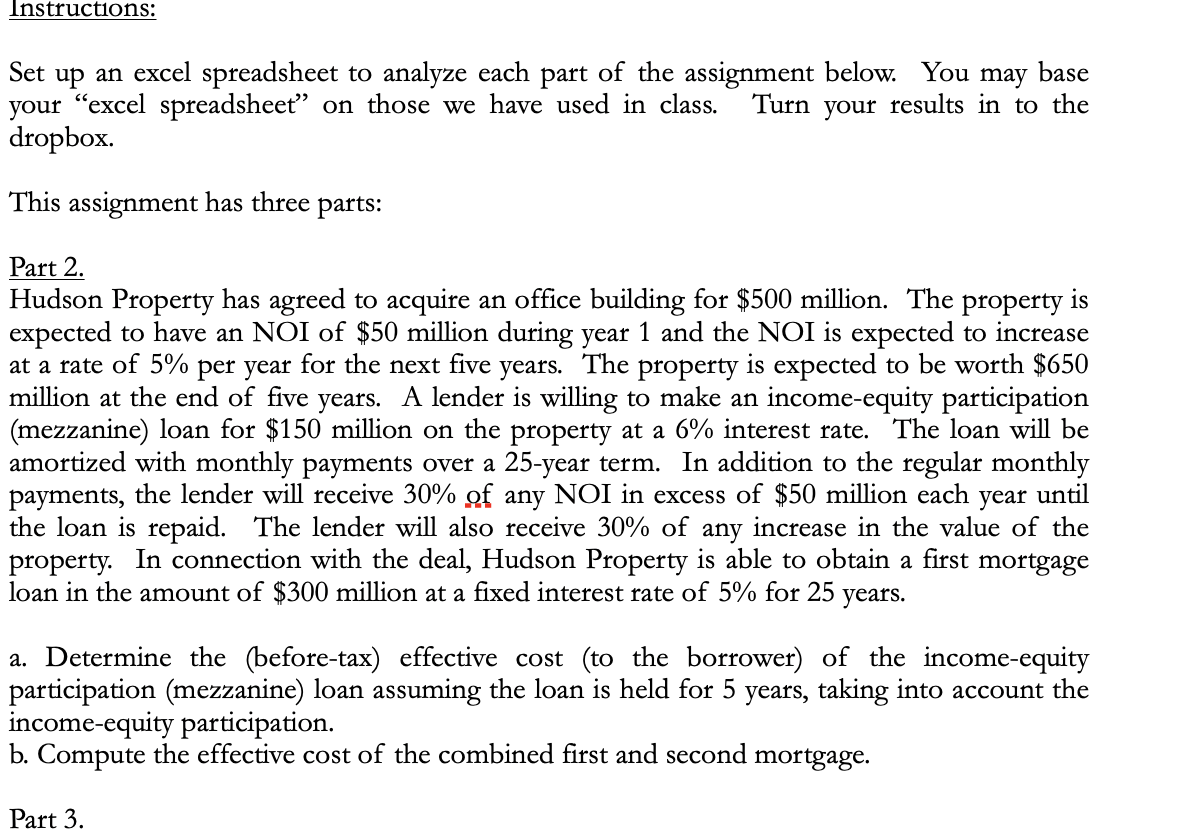

Instructions: Set up an excel spreadsheet to analyze each part of the assignment below. You may base your "excel spreadsheet on those we have used in class. Turn your results in to the dropbox. This assignment has three parts: Part 2. Hudson Property has agreed to acquire an office building for $500 million. The property is expected to have an NOI of $50 million during year 1 and the NOI is expected to increase at a rate of 5% per year for the next five years. The property is expected to be worth $650 million at the end of five years. A lender is willing to make an income-equity participation (mezzanine) loan for $150 million on the property at a 6% interest rate. The loan will be amortized with monthly payments over a 25-year term. In addition to the regular monthly payments, the lender will receive 30% of any NOI in excess of $50 million each year until the loan is repaid. The lender will also receive 30% of any increase in the value of the property. In connection with the deal, Hudson Property is able to obtain a first mortgage loan in the amount of $300 million at a fixed interest rate of 5% for 25 years. a. Determine the (before-tax) effective cost (to the borrower) of the income-equity participation (mezzanine) loan assuming the loan is held for 5 years, taking into account the income-equity participation. b. Compute the effective cost of the combined first and second mortgage. Part 3 Instructions: Set up an excel spreadsheet to analyze each part of the assignment below. You may base your "excel spreadsheet on those we have used in class. Turn your results in to the dropbox. This assignment has three parts: Part 2. Hudson Property has agreed to acquire an office building for $500 million. The property is expected to have an NOI of $50 million during year 1 and the NOI is expected to increase at a rate of 5% per year for the next five years. The property is expected to be worth $650 million at the end of five years. A lender is willing to make an income-equity participation (mezzanine) loan for $150 million on the property at a 6% interest rate. The loan will be amortized with monthly payments over a 25-year term. In addition to the regular monthly payments, the lender will receive 30% of any NOI in excess of $50 million each year until the loan is repaid. The lender will also receive 30% of any increase in the value of the property. In connection with the deal, Hudson Property is able to obtain a first mortgage loan in the amount of $300 million at a fixed interest rate of 5% for 25 years. a. Determine the (before-tax) effective cost (to the borrower) of the income-equity participation (mezzanine) loan assuming the loan is held for 5 years, taking into account the income-equity participation. b. Compute the effective cost of the combined first and second mortgage. Part 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts