Question: Please show equations and work as needed. Also make the answer clear. Thank You. Your company wants to raise $10.5 million by issuing 10-year zero-coupon

Please show equations and work as needed. Also make the answer clear. Thank You.

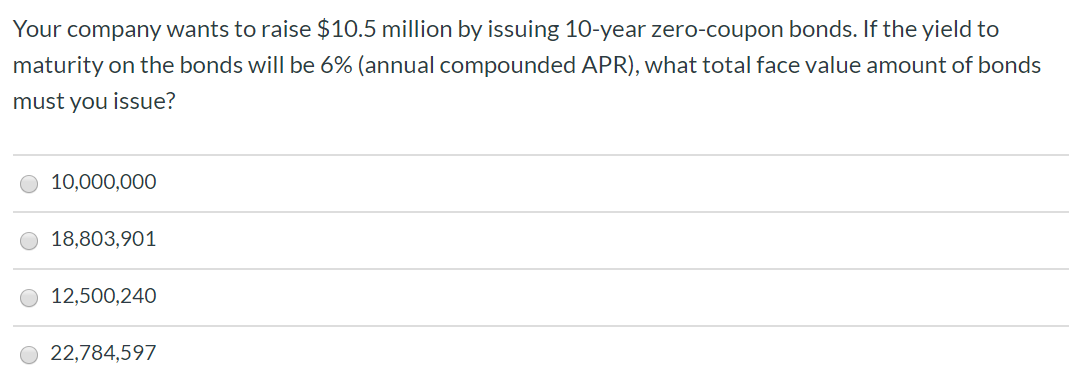

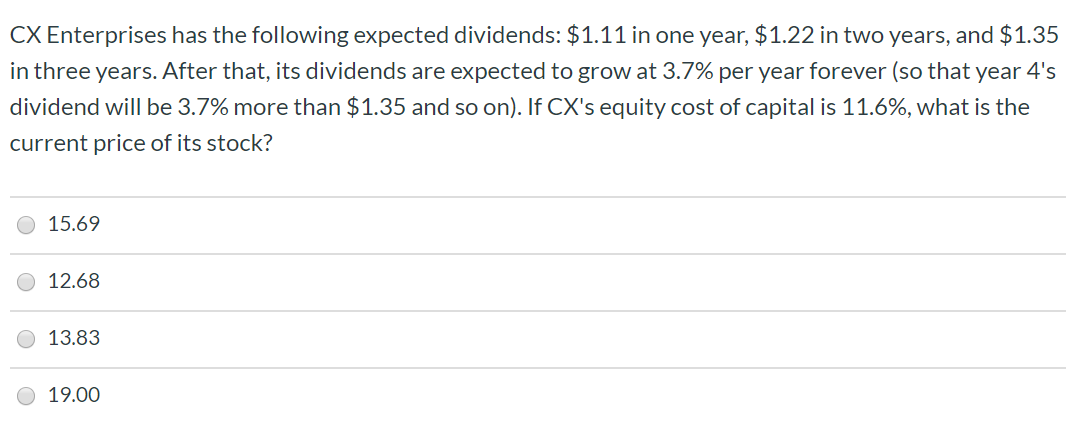

Your company wants to raise $10.5 million by issuing 10-year zero-coupon bonds. If the yield to maturity on the bonds will be 6% (annual compounded APR), what total face value amount of bonds must you issue? 10,000,000 18,803,901 12,500,240 22,784,597 CX Enterprises has the following expected dividends: $1.11 in one year, $1.22 in two years, and $1.35 in three years. After that, its dividends are expected to grow at 3.7% per year forever (so that year 4's dividend will be 3.7% more than $1.35 and so on). If CX's equity cost of capital is 11.6%, what is the current price of its stock? 15.69 12.68 13.83 19.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts