Question: Please show all equations and work as needed. If possible enter the work as text. Also make the answer clear. Thank you. Your company has

Please show all equations and work as needed. If possible enter the work as text. Also make the answer clear. Thank you.

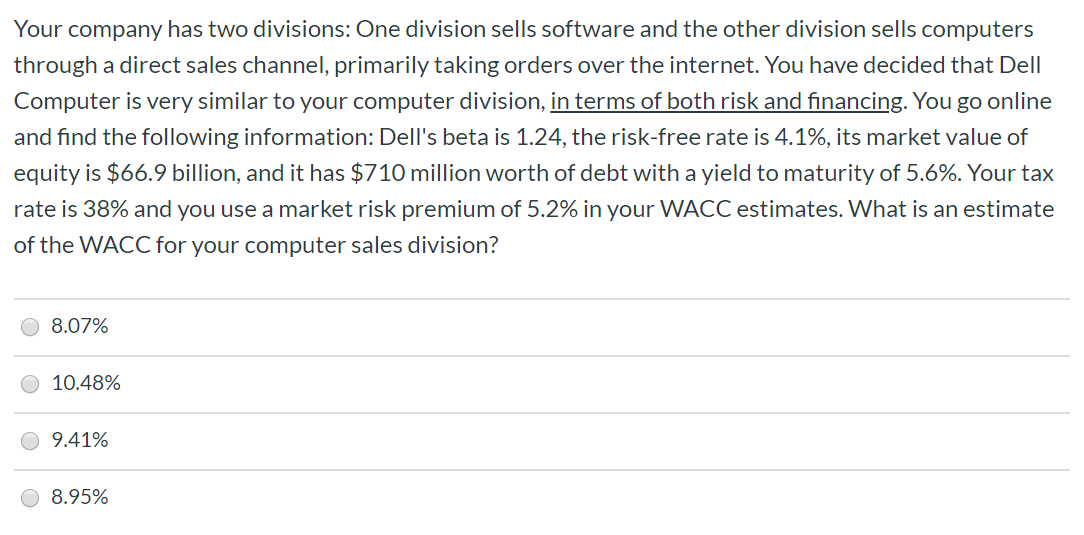

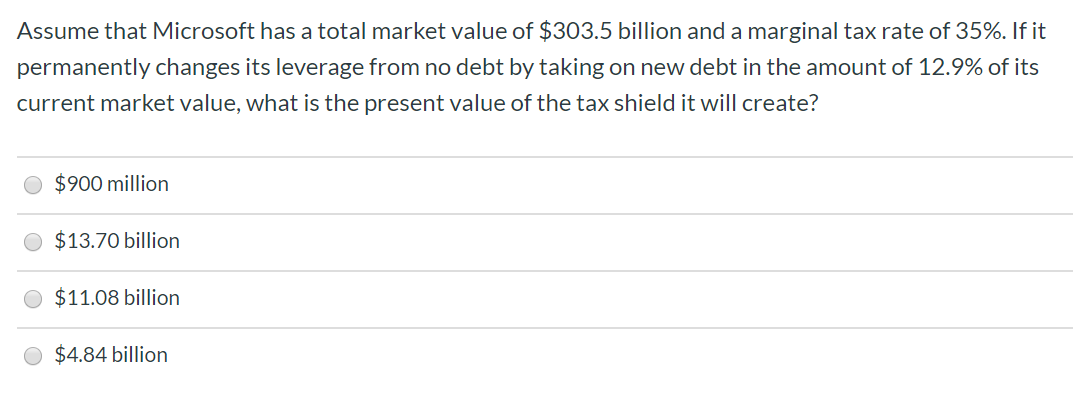

Your company has two divisions: One division sells software and the other division sells computers through a direct sales channel, primarily taking orders over the internet. You have decided that Dell Computer is very similar to your computer division, in terms of both risk and financing. You go online and find the following information: Dell's beta is 1.24, the risk-free rate is 4.1%, its market value of equity is $66.9 billion, and it has $710 million worth of debt with a yield to maturity of 5.6%. Your tax rate is 38% and you use a market risk premium of 5.2% in your WACC estimates. What is an estimate of the WACC for your computer sales division? 08.07% 10.48% 09.41% O 8.95% Assume that Microsoft has a total market value of $303.5 billion and a marginal tax rate of 35%. If it permanently changes its leverage from no debt by taking on new debt in the amount of 12.9% of its current market value, what is the present value of the tax shield it will create? $900 million O $13.70 billion O $11.08 billion $4.84 billion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts