Question: please show excel calculations (The next 5 questions will be based on this problem) A firm has two $10,000 (initial investment), Mutually Exclusive investment alternatives

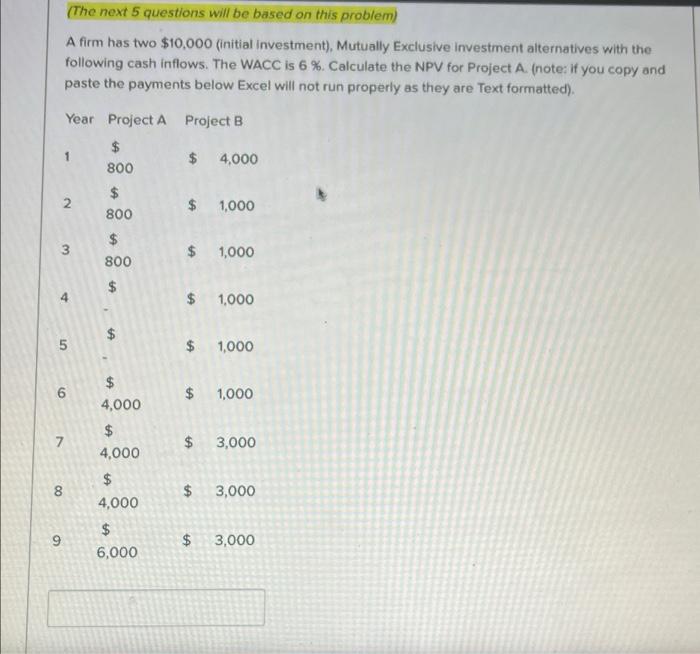

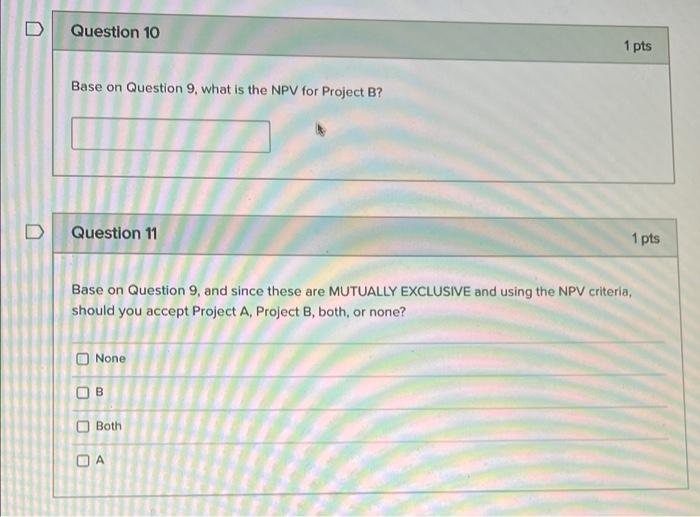

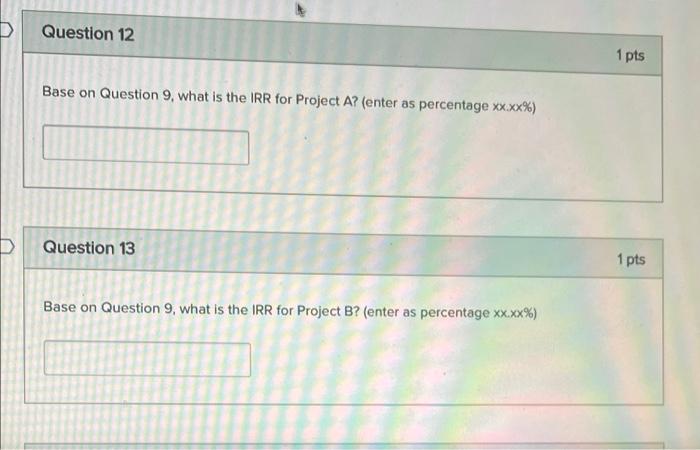

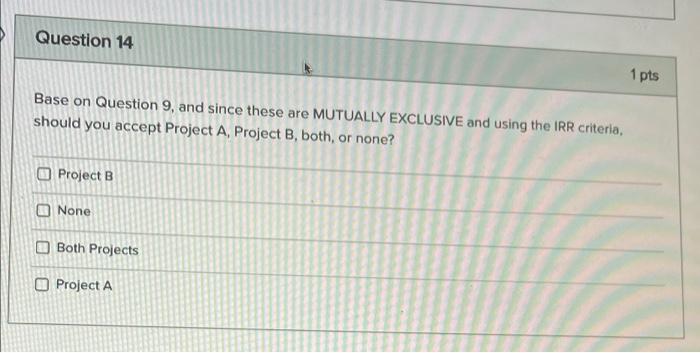

(The next 5 questions will be based on this problem) A firm has two $10,000 (initial investment), Mutually Exclusive investment alternatives with the following cash inflows. The WACC is 6 %. Calculate the NPV for Project A. (note: if you copy and paste the payments below Excel will not run properly as they are Text formatted). Year Project A Project B $ 1 $ 4,000 800 2 $ 800 $ 1,000 $ $ 1,000 800 $ $1,000 $ 1,000 $ 1,000 $ 3,000 $ 3,000 3,000 3 4 5 6 7 8 9 m 599 $ 4,000 $ 4,000 $ 4,000 $ 6,000 GA 6960 LA $ Question 10 Base on Question 9, what is the NPV for Project B? Question 11 1 pts Base on Question 9, and since these are MUTUALLY EXCLUSIVE and using the NPV criteria, should you accept Project A, Project B, both, or none? None B Both DA 1 pts Question 12 Base on Question 9, what is the IRR for Project A? (enter as percentage xx.xx%) Question 13 Base on Question 9, what is the IRR for Project B? (enter as percentage xx.xx%) 1 pts 1 pts Question 14 1 pts Base on Question 9, and since these are MUTUALLY EXCLUSIVE and using the IRR criteria, should you accept Project A, Project B, both, or none? Project B None Both Projects Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts