Question: Please show excel formulas used. I'm not sure if the boxes in yellow are correct. 1. We will compute the cost of equity for Ford

Please show excel formulas used. I'm not sure if the boxes in yellow are correct.

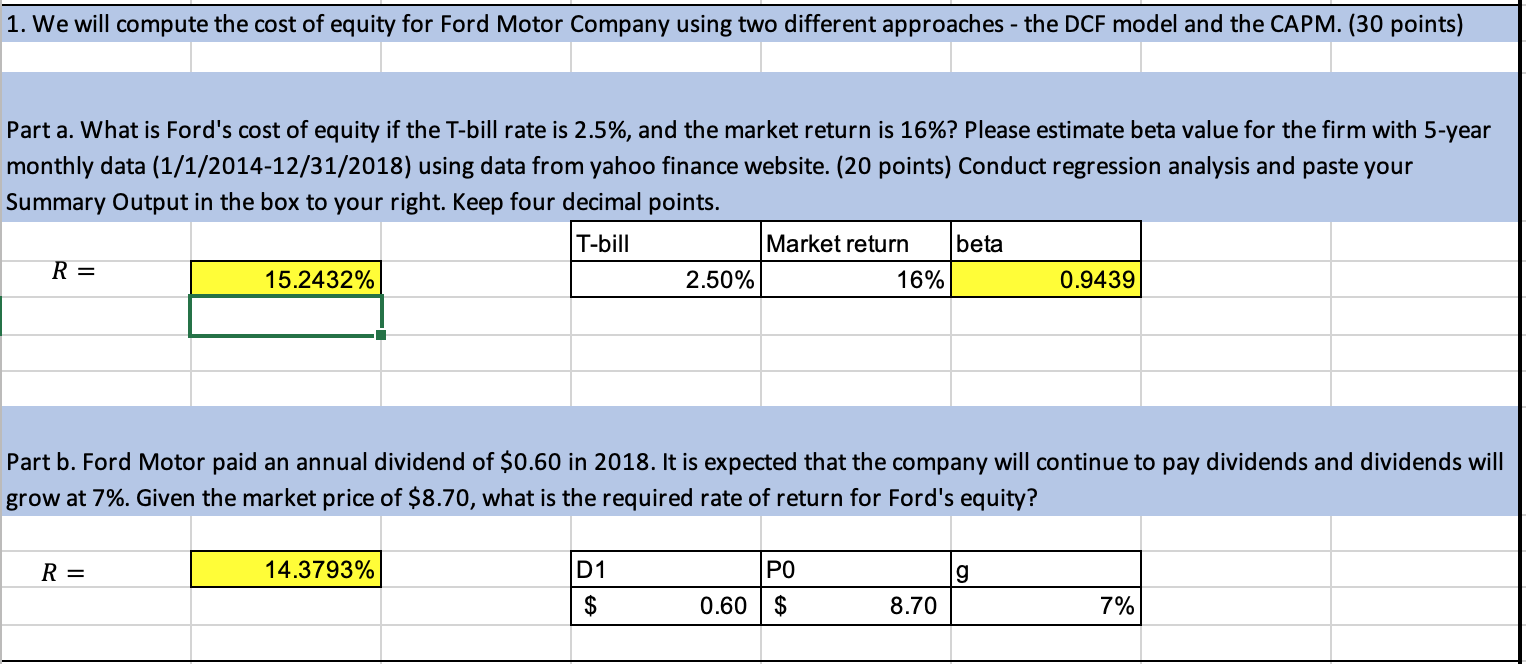

1. We will compute the cost of equity for Ford Motor Company using two different approaches - the DCF model and the CAPM. (30 points) Part a. What is Ford's cost of equity if the T-bill rate is 2.5%, and the market return is 16%? Please estimate beta value for the firm with 5-year monthly data (1/1/2014-12/31/2018) using data from yahoo finance website. (20 points) Conduct regression analysis and paste your Summary Output in the box to your right. Keep four decimal points. T-bill Market return beta R= 15.2432% 2.50% 16% 0.9439 Part b. Ford Motor paid an annual dividend of $0.60 in 2018. It is expected that the company will continue to pay dividends and dividends will grow at 7%. Given the market price of $8.70, what is the required rate of return for Ford's equity? R= 14.3793% PO g D1 $ 0.60 $ 8.70 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts