Question: Please show excel step every step and please for each question if you can interpret the answers and what the significance for each answer means

Please show excel step every step and please for each question if you can interpret the answers and what the significance for each answer means specifically part B and C. VaR (Value at Risk)

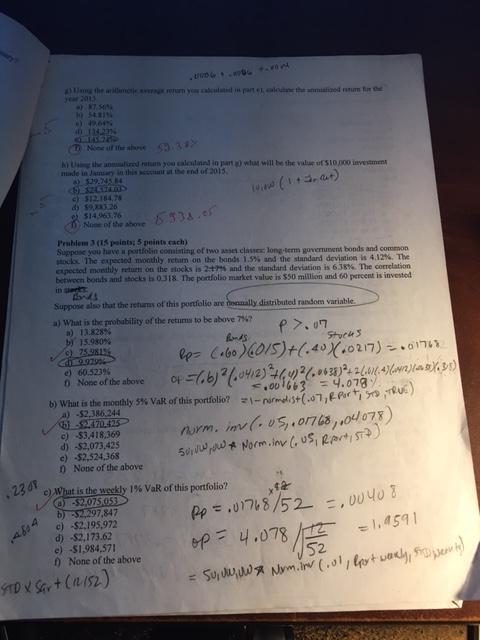

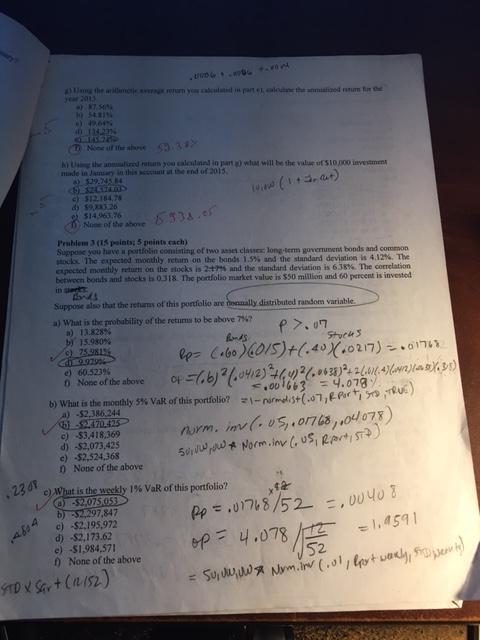

000+ Ung the arillanetic everage return your calculated in part e, salone the annuatized umfe year 2013 4) KT.54N NO SERIN 360 40 114,231 6129 None of the shove 55.38X N) Using the analized returns you calexland in part ) what will be the value of $10,000 investment made in Jamsary in this account at the end of 2015 4) $29.245 84 .07 Bonds Stucks by 15.980 % c) 75.981% 9.97906 &p= (160) (015) + (-40) (20217) = .01768 e) 60.523% 0 None of the above 0+=(. b)2(0412) 46, 472 (0.0628) + 2 (41(-4) (1002) 30X. 31) = .001663 = 4.078 b) What is the monthly 5% VaR of this portfolio? 21-normal.3+(-07, R Port, STD, TRUE) a) -$2,386,244 -$2470.425 c) -$3,418,369 d) -$2,073,425 e) -$2,524,368 norm. inv(.05, 01768,004078) 50, Norm. in ( US, RAN, STD) None of the above e) What is the weekly 1% VaR of this portfolio? -$2,075.053 x2 b) 52.297,847 c) -$2,195,972 d) -$2,173.62 e) -$1,984,571 f) None of the above op = 4.078/52 PP = .01768/52 =,00408 = 1.4591 = 50, Nym.in (.01, Port warly, STD weavity) 200 .23 09 STD X Sar+ (12152) 000+ Ung the arillanetic everage return your calculated in part e, salone the annuatized umfe year 2013 4) KT.54N NO SERIN 360 40 114,231 6129 None of the shove 55.38X N) Using the analized returns you calexland in part ) what will be the value of $10,000 investment made in Jamsary in this account at the end of 2015 4) $29.245 84 .07 Bonds Stucks by 15.980 % c) 75.981% 9.97906 &p= (160) (015) + (-40) (20217) = .01768 e) 60.523% 0 None of the above 0+=(. b)2(0412) 46, 472 (0.0628) + 2 (41(-4) (1002) 30X. 31) = .001663 = 4.078 b) What is the monthly 5% VaR of this portfolio? 21-normal.3+(-07, R Port, STD, TRUE) a) -$2,386,244 -$2470.425 c) -$3,418,369 d) -$2,073,425 e) -$2,524,368 norm. inv(.05, 01768,004078) 50, Norm. in ( US, RAN, STD) None of the above e) What is the weekly 1% VaR of this portfolio? -$2,075.053 x2 b) 52.297,847 c) -$2,195,972 d) -$2,173.62 e) -$1,984,571 f) None of the above op = 4.078/52 PP = .01768/52 =,00408 = 1.4591 = 50, Nym.in (.01, Port warly, STD weavity) 200 .23 09 STD X Sar+ (12152)