Question: please show formula Do the following questions using Excel. Make sure you save your file. You will submit your Excel file under questions 5 when

please show formula

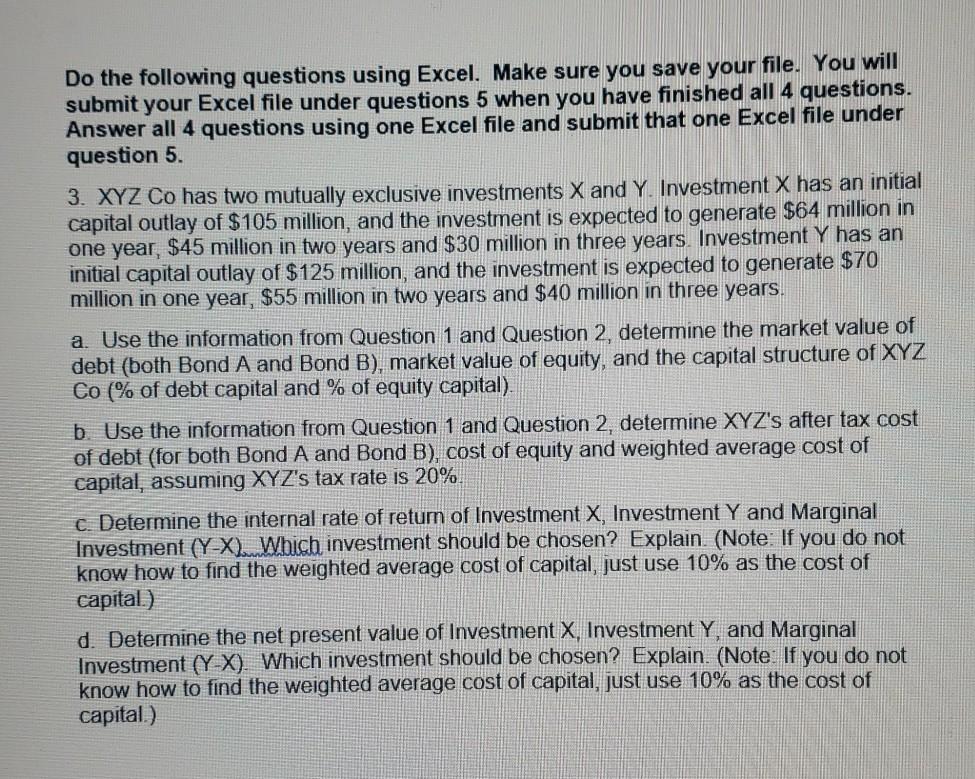

Do the following questions using Excel. Make sure you save your file. You will submit your Excel file under questions 5 when you have finished all 4 questions. Answer all 4 questions using one Excel file and submit that one Excel file under question 5. 3. XYZ Co has two mutually exclusive investments X and Y. Investment X has an initial capital outlay of $105 million, and the investment is expected to generate $64 million in one year, $45 million in two years and $30 million in three years Investment Y has an initial capital outlay of $125 million, and the investment is expected to generate $70 million in one year, $55 million in two years and $40 million in three years. a. Use the information from Question 1 and Question 2, determine the market value of debt (both Bond A and Bond B), market value of equity, and the capital structure of XYZ Co (% of debt capital and % of equity capital) b. Use the information from Question 1 and Question 2, determine XYZ's after tax cost of debt (for both Bond A and Bond B), cost of equity and weighted average cost of capital, assuming XYZ's tax rate is 20% c. Determine the internal rate of retum of Investment X, Investment Y and Marginal Investment (Y-X). Which investment should be chosen? Explain. (Note: If you do not know how to find the weighted average cost of capital, just use 10% as the cost of capital.) d. Determine the net present value of Investment x, Investment Y, and Marginal Investment (Y-X). Which investment should be chosen? Explain. (Note: If you do not know how to find the weighted average cost of capital, just use 10% as the cost of capital.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts