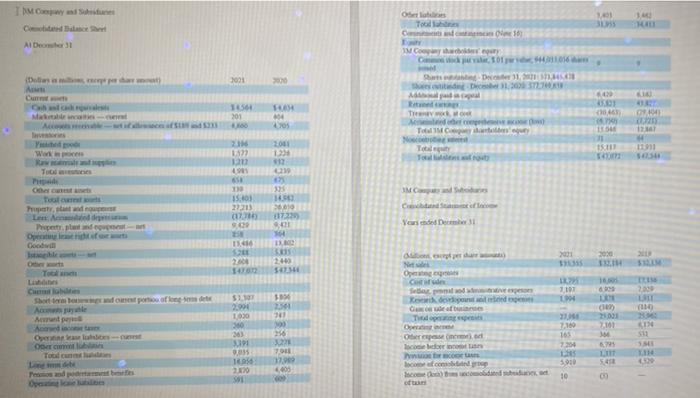

Question: please show formula TIM Cawan One Tood Al De 1 . IMC 006 Dan De 20 Delia 001 2000 Man 16564 4 2014 os TO

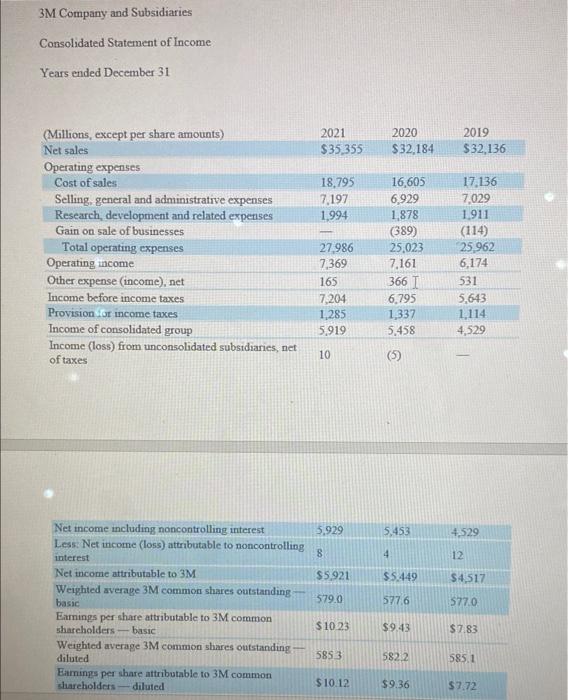

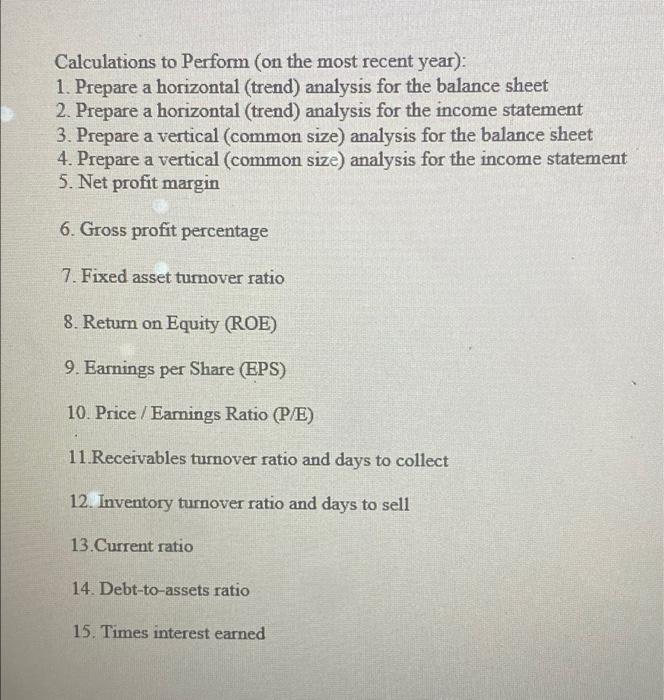

TIM Cawan One Tood Al De 1 . IMC 006 Dan De 20 Delia 001 2000 Man 16564 4 2014 os TO 30,46 TMC 15 LIS 11011 2001 122 123 17 1903 TICE Tu BE SEK IM 15:03 140 22.213 10 (2 17:22 O 01 LA pert Yours des December 31 HE I DO 1135 dar 2030 2440 54234 HII To Open 001 10 L. 2007 CH LES 2.50 2.04 1030 31 30 Art Seppo Redondo This OM Op Isolido TO A101 IN Opera 7.100 165 7354 30 Tocal LI TE 20 12. 6.000 du R 010 54 09 coded IS 10 3M Company and Subsidiaries Consolidated Statement of Income Years ended December 31 2021 $35.355 2020 $32.184 2019 $32.136 18,795 7,197 1994 (Millions, except per share amounts) Net sales Operating expenses Cost of sales Selling, general and administrative expenses Research, development and related expenses Gain on sale of businesses Total operating expenses Operating income Other expense (income), net Income before income taxes Provision or income taxes Income of consolidated group Income (loss) from unconsolidated subsidiaries, net of taxes 27986 7.369 165 7.204 1,285 5.919 16,605 6.929 1,878 (389) 25,023 7.161 366 I 6,795 1,337 5,458 17.136 7,029 1.911 (114) 25.962 6,174 531 5,643 1.114 4,529 10 (5) 5,929 5,453 4,529 8 4 12 $5.921 $5449 $4,517 579.0 577.6 Net income including noncontrolling interest Less: Net income (loss) attributable to noncontrolling interest Net income attributable to 3M Weighted average 3M common shares outstanding basic Earnings per share attributable to 3M common shareholders - basic Weighted average 3M common shares outstanding diluted Earings per share attributable to 3M common shareholders diluted 5770 $10 23 $9.43 $7.83 5853 5822 585.1 $10.12 $9.36 $7.72 Calculations to Perform (on the most recent year): 1. Prepare a horizontal (trend) analysis for the balance sheet 2. Prepare a horizontal (trend) analysis for the income statement 3. Prepare a vertical (common size) analysis for the balance sheet 4. Prepare a vertical (common size) analysis for the income statement 5. Net profit margin 6. Gross profit percentage 7. Fixed asset turnover ratio 8. Return on Equity (ROE) 9. Earnings per Share (EPS) 10. Price / Earnings Ratio (P/E) 11 Receivables turnover ratio and days to collect 12. Inventory turnover ratio and days to sell 13.Current ratio 14. Debt-to-assets ratio 15. Times interest earned

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts