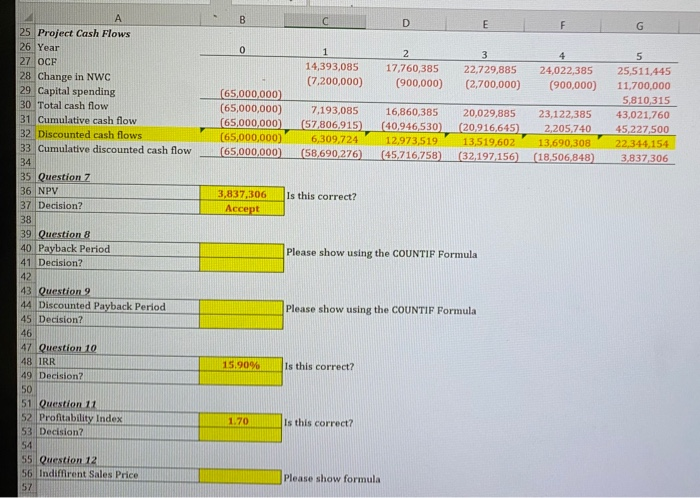

Question: please show how to answer the questions using Excel formulas. Thank you. Problem and input data F 14,393,085 (7,200,000) 17,760,385 (900,000) 22,729,885 (2,700,000) 24,022,385 (900,000)

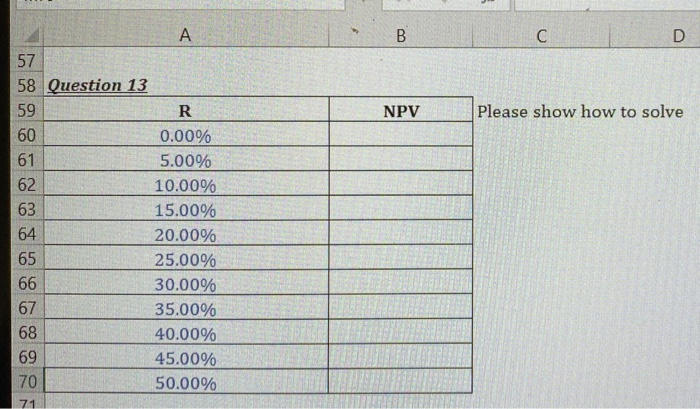

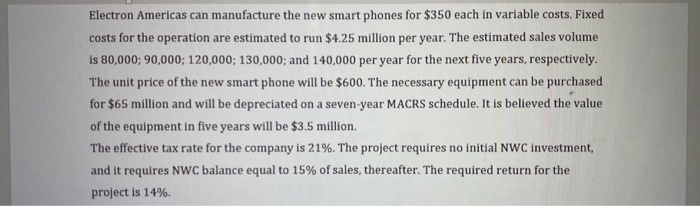

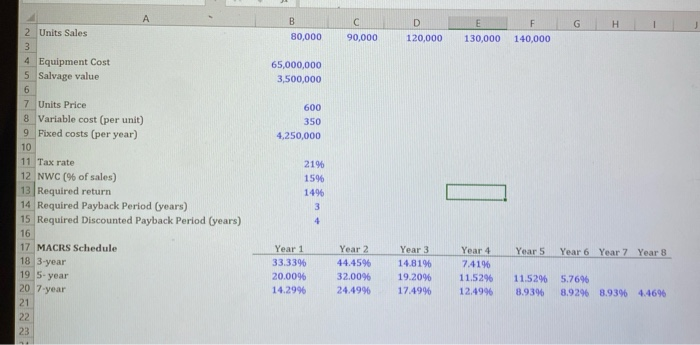

F 14,393,085 (7,200,000) 17,760,385 (900,000) 22,729,885 (2,700,000) 24,022,385 (900,000) 25 Project Cash Flows 26 Year 27 OCF 28 Change in NWC 29 Capital spending 30 Total cash flow 31 Cumulative cash flow 32 Discounted cash flows 33 Cumulative discounted cash flow (65,000,000) (65,000,000) (65,000,000) (65,000,000) (65,000,000 7,193,085 (57,806,915) 6,309.724 (58,690,276) 16,860,385 (40,946,530) 12,973,519' (45,716,758) 20,029,885 23,122,385 (20,916,645) 2,205,740 13,519,602 13.690,308 (32,197,156)_(18,506,848) 25,511,445 11,700,000 5,810,315 43,021,760 45,227,500 22,344,154 3,837 306 3,837,306 Is this correct? Accept 35 Question 2 36 NPV 37 Decision? 38 39 Question 8 40 Payback Period 41 Decision? 42 43 Question 44 Discounted Payback Period 45 Decision? Please show using the COUNTIF Formula Please show using the COUNTIF Formula 46 47 Question 10 48 IRR 49 Decision? 15.90% . Is this correct? 51 Question 11 52 Profitability Index 53 Decision? 1.70 Is this correct? 55 Question 12 56 Indiffrent Sales Price Please show formula 57 51 ST NPV Please show how to solve 58 Question 13 59 R 600 .00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00% 40.00% 45.00% 50.00% WA R RANEANETA Electron Americas can manufacture the new smart phones for $350 each in variable costs. Fixed costs for the operation are estimated to run $4.25 million per year. The estimated sales volume is 80,000; 90,000; 120,000; 130,000; and 140,000 per year for the next five years, respectively. The unit price of the new smart phone will be $600. The necessary equipment can be purchased for $65 million and will be depreciated on a seven-year MACRS schedule. It is believed the value of the equipment in five years will be $3.5 million. The effective tax rate for the company is 21%. The project requires no initial NWC investment, and it requires NWC balance equal to 15% of sales, thereafter. The required return for the project is 14% G H I 2 Units Sales F 140,000 80,000 90,000 120,000 130,000 4 Equipment Cost 5 Salvage value 65,000,000 3,500,000 600 7 Units Price 8 Variable cost (per unit) 9 Fixed costs (per year) 350 4,250,000 2196 1596 11 Tax rate 12 NWC (% of sales) 13 Required return 14 Required Payback Period (years) 15 Required Discounted Payback Period (years) 1496 17 MACRS Schedule 18 3-year Year 5 Year 6 Year 7 Year 8 19 5 year 20 7-year Year 1 33.3396 20.0096 14.2996 Year 2 44.45% 32.00% 24.4996 Year 3 14.81% 19.20% 17.4996 Year 4 7.41% 11.52% 12.4996 11.52% 8.93% 5.76% 8.9296 8.93% 4.4696 F 14,393,085 (7,200,000) 17,760,385 (900,000) 22,729,885 (2,700,000) 24,022,385 (900,000) 25 Project Cash Flows 26 Year 27 OCF 28 Change in NWC 29 Capital spending 30 Total cash flow 31 Cumulative cash flow 32 Discounted cash flows 33 Cumulative discounted cash flow (65,000,000) (65,000,000) (65,000,000) (65,000,000) (65,000,000 7,193,085 (57,806,915) 6,309.724 (58,690,276) 16,860,385 (40,946,530) 12,973,519' (45,716,758) 20,029,885 23,122,385 (20,916,645) 2,205,740 13,519,602 13.690,308 (32,197,156)_(18,506,848) 25,511,445 11,700,000 5,810,315 43,021,760 45,227,500 22,344,154 3,837 306 3,837,306 Is this correct? Accept 35 Question 2 36 NPV 37 Decision? 38 39 Question 8 40 Payback Period 41 Decision? 42 43 Question 44 Discounted Payback Period 45 Decision? Please show using the COUNTIF Formula Please show using the COUNTIF Formula 46 47 Question 10 48 IRR 49 Decision? 15.90% . Is this correct? 51 Question 11 52 Profitability Index 53 Decision? 1.70 Is this correct? 55 Question 12 56 Indiffrent Sales Price Please show formula 57 51 ST NPV Please show how to solve 58 Question 13 59 R 600 .00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00% 40.00% 45.00% 50.00% WA R RANEANETA Electron Americas can manufacture the new smart phones for $350 each in variable costs. Fixed costs for the operation are estimated to run $4.25 million per year. The estimated sales volume is 80,000; 90,000; 120,000; 130,000; and 140,000 per year for the next five years, respectively. The unit price of the new smart phone will be $600. The necessary equipment can be purchased for $65 million and will be depreciated on a seven-year MACRS schedule. It is believed the value of the equipment in five years will be $3.5 million. The effective tax rate for the company is 21%. The project requires no initial NWC investment, and it requires NWC balance equal to 15% of sales, thereafter. The required return for the project is 14% G H I 2 Units Sales F 140,000 80,000 90,000 120,000 130,000 4 Equipment Cost 5 Salvage value 65,000,000 3,500,000 600 7 Units Price 8 Variable cost (per unit) 9 Fixed costs (per year) 350 4,250,000 2196 1596 11 Tax rate 12 NWC (% of sales) 13 Required return 14 Required Payback Period (years) 15 Required Discounted Payback Period (years) 1496 17 MACRS Schedule 18 3-year Year 5 Year 6 Year 7 Year 8 19 5 year 20 7-year Year 1 33.3396 20.0096 14.2996 Year 2 44.45% 32.00% 24.4996 Year 3 14.81% 19.20% 17.4996 Year 4 7.41% 11.52% 12.4996 11.52% 8.93% 5.76% 8.9296 8.93% 4.4696

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts