Question: Please show formulas and figures, not excel :( 2. You are thinking of buying a financial asset. The asset has the following cash flows: -

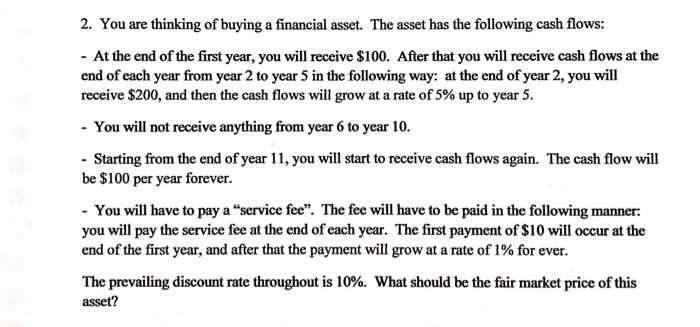

2. You are thinking of buying a financial asset. The asset has the following cash flows: - At the end of the first year, you wil receive $100. After that you will receive cash flows at the end of each year from year 2 to year 5 in the following way: at the end of year 2, you will receive $200, and then the cash flows will grow at a rate of 5% up to year 5. - You will not receive anything from year 6 to year 10 - Starting from the end of year 11, you will start to receive cash flows again. The cash flow will be $100 per year forever. You will have to pay a "service fee". The fee will have to be paid in the following manner: you will pay the service fee at the end of each year. The first payment of $10 will occur at the end of the first year, and after that the payment will grow at a rate of 1% for ever. The prevailing discount rate throughout is 10%. What should be the fair market price of this asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts