Question: please show formulas and steps used. keep at least 4 decimal places ABC incorporated has three bonds issued at par ($1000) with the following attributes:

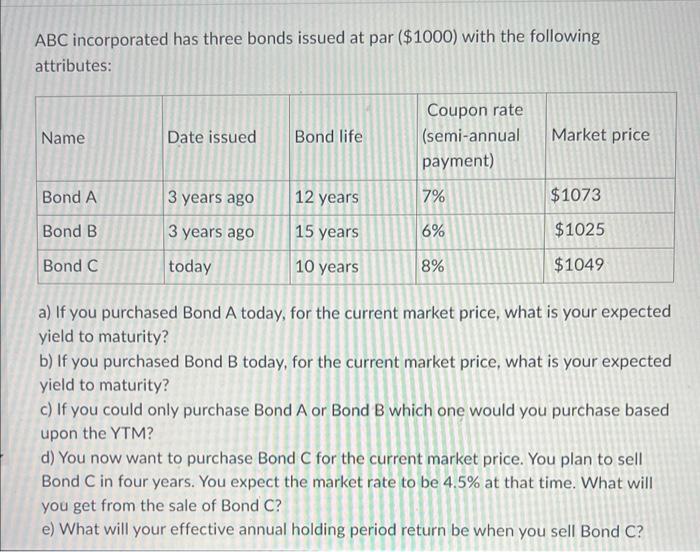

ABC incorporated has three bonds issued at par ($1000) with the following attributes: a) If you purchased Bond A today, for the current market price, what is your expected yield to maturity? b) If you purchased Bond B today, for the current market price, what is your expected yield to maturity? c) If you could only purchase Bond A or Bond B which one would you purchase based upon the YTM? d) You now want to purchase Bond C for the current market price. You plan to sell Bond C in four years. You expect the market rate to be 4.5% at that time. What will you get from the sale of Bond C ? e) What will your effective annual holding period return be when you sell Bond C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts