Question: Please show formulas not just excel You are considering the purchase of a car and then leasing it to another student on campus. You would

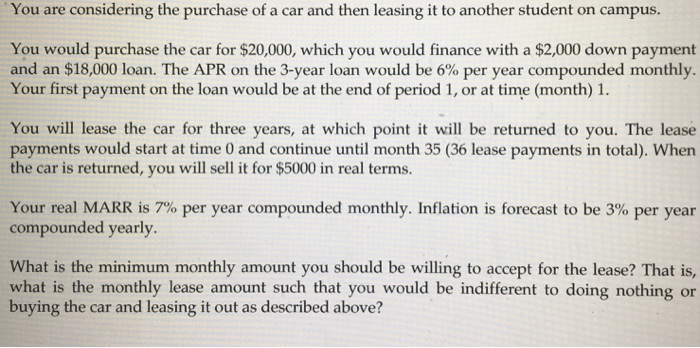

You are considering the purchase of a car and then leasing it to another student on campus. You would purchase the car for $20,000, which you would finance with a $2,000 down payment and an $18,000 loan. The APR on the 3-year loan would be 6% per year compounded monthly. Your first payment on the loan would be at the end of period 1, or at time (month) 1. You will lease the car for three years, at which point it will be returned to you. The lease payments would start at time 0 and continue until month 35 (36 lease payments in total). When the car is returned, you will sell it for $5000 in real terms. Your real MARR is 7% per year compounded monthly. Inflation is forecast to be 3% per year compounded yearly What is the minimum monthly amount you should be willing to accept for the lease? That is, what is the monthly lease amount such that you would be indifferent to doing nothing or buying the car and leasing it out as described above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts