Question: Please show formulas on excel. Problem 5 King Fisher Aviation issued a 25 year, 6.8 percent semiannual bond 8 years ago. The bond sells today

Please show formulas on excel.

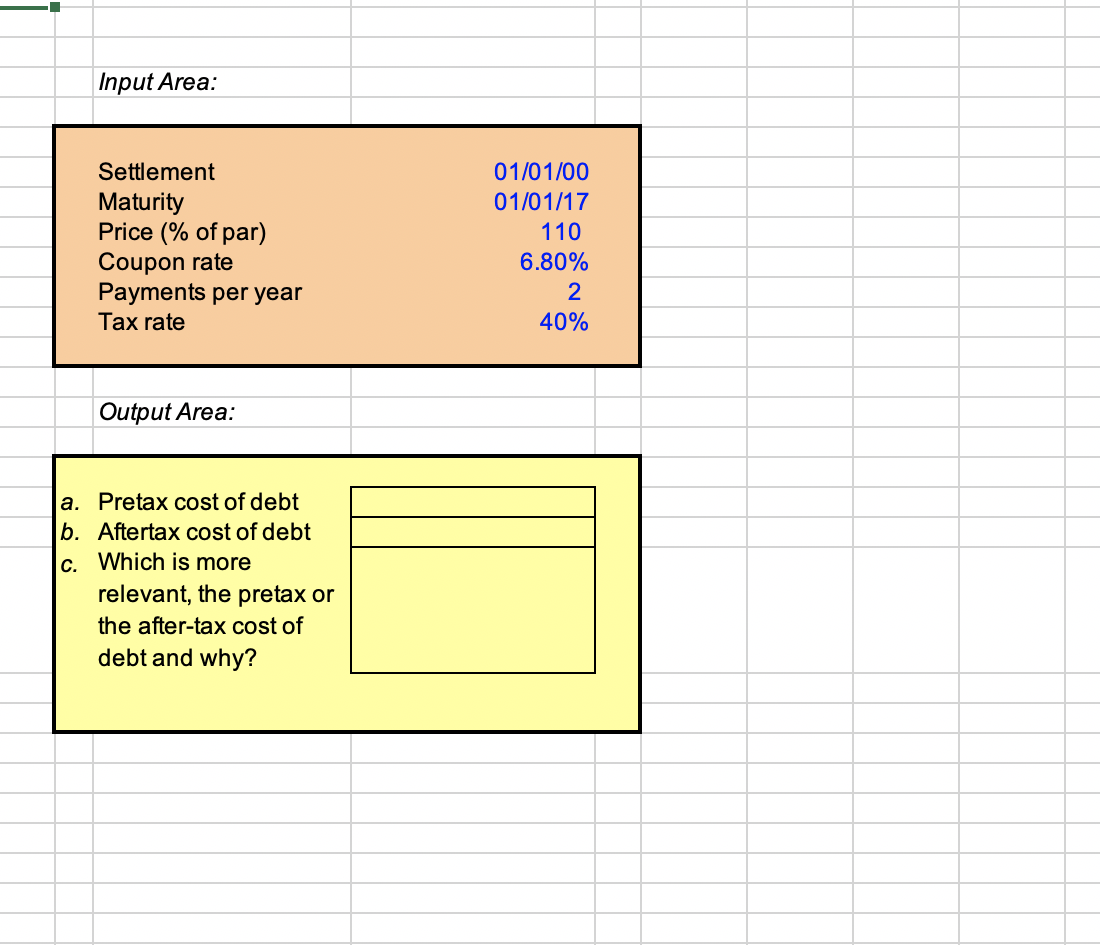

Problem 5 King Fisher Aviation issued a 25 year, 6.8 percent semiannual bond 8 years ago. The bond sells today for 110 percent of its face value. The tax rate is 40%. 1. What is the pretax cost of debt? 2. What is the after-tax cost of debt? 3. Which is more relevant, the pretax or the after-tax cost of debt? Why? Fill in the values in the spreadsheet. Input Area: Settlement Maturity Price (% of par) Coupon rate Payments per year Tax rate 01/01/00 01/01/17 110 6.80% 40% Output Area: a. Pretax cost of debt b. Aftertax cost of debt c. Which is more relevant, the pretax or the after-tax cost of debt and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts