Question: Please show formulas so I can understand the assignment better. Thank you! This project is about preparing a pro forma income statement for a newly

Please show formulas so I can understand the assignment better. Thank you!

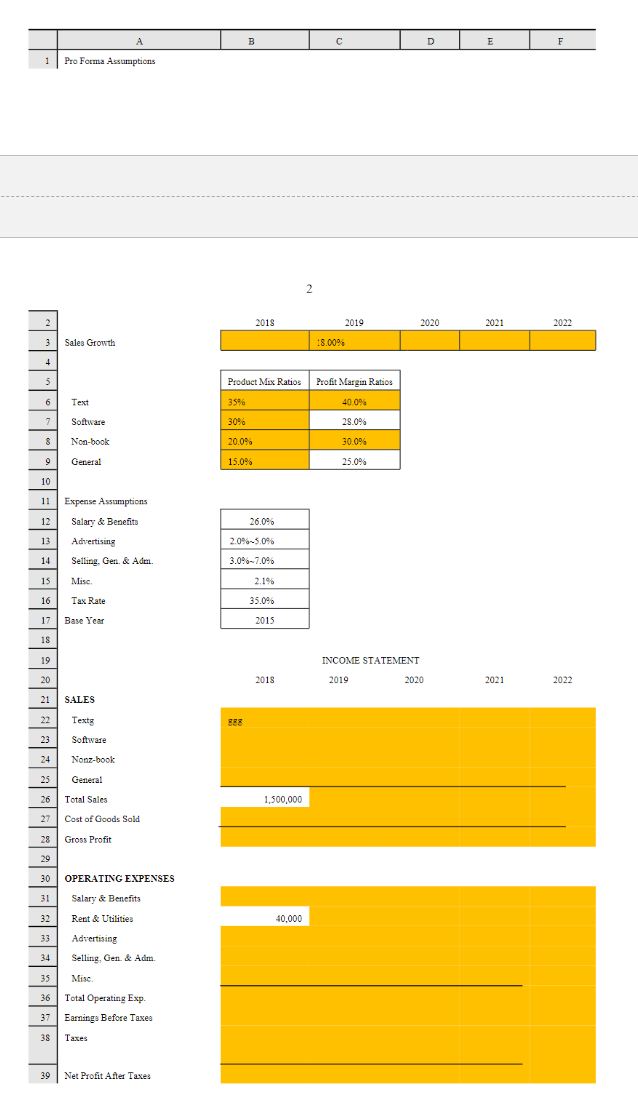

This project is about preparing a pro forma income statement for a newly opened private bookstore. This bookstore expects sales of $1,500,000 in the first year (2018). The sales growth rate for year 2 is 18.0%. It grows up to be, 19.0% in year 3 , and slowing down to be 15.0% and 14.0% and 16.0% in years 4 and 5 respectively. The usual product mix in a collegiate bookstore is textbooks, software, non-book supplies (such as clothing, pens, notebooks, etc.), and general books (such as fiction, classics, reference, cookbooks, etc.). Such a product mix is usually necessary for offsetting both the low margins allowed for texts and the expenses of doing business. The Profit Margin Ratio (PMR) for each product is: Profit of the product divided by the Sales of the product. In addition, this bookstore estimates the following percentages of sales for various expenses: The Rent \& Utility expense is $40,000 for the first year (2018), and grows at a different rate for each year as determined by the following formula: 6.5%+0.2% (number of years away from the base year) 1/2. Taxes are paid only when the Earnings Before Taxes is non-negative. ASSIGNMENTS: (Make sure that worksheet data, B22 E39, are formatted as currency with no decimals. The rest of the worksheet assumptions are formatted as percent with one decimal.) 1. Using Exhibit 1 (please do NOT change any item's cell address) to conduct Data Table analysis for 2019 Net Profit After Taxes by changing the Advertising from 2.0\%-5.0\% with step 0.5%, and General, Selling, and Administration from 3.0% to 7.0% with step 0.5%. Show your Data Table. 2. Which combination of Advertising and GSA expenses will yield the largest NPAT? 3. Conduct Data Table analysis and repeat the above two questions for step size as 0.25% this time. 4. Which combination of Advertising and GSA expenses will yield the largest NPAT? 5. Conduct Data Table analysis and repeat the above two questions for step size as 0.1% this time. 6. Which combination of Advertising and GSA expenses will yield the largest NPAT? \begin{tabular}{c|c|c|c|c|c|c} \hline & \multicolumn{1}{|c|}{ A } & B & C & D & E & F \\ \hline 1 & Pro Forma Assumptions - & & & \end{tabular} 2 \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{4}{c}{2019} & \multicolumn{2}{c}{2020} & 2021 & 2022 \\ \hline & :8.00% & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|} \hline Product Mix Ratios & Profit Margin Ratios \\ \hline 35% & 40.0% \\ \hline 30% & 28.0% \\ \hline 20.0% & 30.0% \\ \hline 15.0% & 25.0% \\ \hline \end{tabular} Expense Assumptions Salary \& Benefits Advertising Selling, Gen. \& Adm Misc. Tax Rate Base Year \begin{tabular}{|r|} \hline 26.0% \\ \hline 2.0%5.0% \\ \hline 3.0%7.0% \\ \hline 2.1% \\ \hline 35.0% \\ \hline 2015 \\ \hline \end{tabular} INCOME STATEMENT SALES Textg Software Nonz-book General Total Sales Cost of Goods Sold Gross Profit OPERATING EXPENSES Salary \& Benefits Rent \& Utilities Advertising Selling, Gen. \& Adm. Mise. Total Operating Exp. Earnings Before Taxes Taxes 39 Net Profit After Taxes This project is about preparing a pro forma income statement for a newly opened private bookstore. This bookstore expects sales of $1,500,000 in the first year (2018). The sales growth rate for year 2 is 18.0%. It grows up to be, 19.0% in year 3 , and slowing down to be 15.0% and 14.0% and 16.0% in years 4 and 5 respectively. The usual product mix in a collegiate bookstore is textbooks, software, non-book supplies (such as clothing, pens, notebooks, etc.), and general books (such as fiction, classics, reference, cookbooks, etc.). Such a product mix is usually necessary for offsetting both the low margins allowed for texts and the expenses of doing business. The Profit Margin Ratio (PMR) for each product is: Profit of the product divided by the Sales of the product. In addition, this bookstore estimates the following percentages of sales for various expenses: The Rent \& Utility expense is $40,000 for the first year (2018), and grows at a different rate for each year as determined by the following formula: 6.5%+0.2% (number of years away from the base year) 1/2. Taxes are paid only when the Earnings Before Taxes is non-negative. ASSIGNMENTS: (Make sure that worksheet data, B22 E39, are formatted as currency with no decimals. The rest of the worksheet assumptions are formatted as percent with one decimal.) 1. Using Exhibit 1 (please do NOT change any item's cell address) to conduct Data Table analysis for 2019 Net Profit After Taxes by changing the Advertising from 2.0\%-5.0\% with step 0.5%, and General, Selling, and Administration from 3.0% to 7.0% with step 0.5%. Show your Data Table. 2. Which combination of Advertising and GSA expenses will yield the largest NPAT? 3. Conduct Data Table analysis and repeat the above two questions for step size as 0.25% this time. 4. Which combination of Advertising and GSA expenses will yield the largest NPAT? 5. Conduct Data Table analysis and repeat the above two questions for step size as 0.1% this time. 6. Which combination of Advertising and GSA expenses will yield the largest NPAT? \begin{tabular}{c|c|c|c|c|c|c} \hline & \multicolumn{1}{|c|}{ A } & B & C & D & E & F \\ \hline 1 & Pro Forma Assumptions - & & & \end{tabular} 2 \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{4}{c}{2019} & \multicolumn{2}{c}{2020} & 2021 & 2022 \\ \hline & :8.00% & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|} \hline Product Mix Ratios & Profit Margin Ratios \\ \hline 35% & 40.0% \\ \hline 30% & 28.0% \\ \hline 20.0% & 30.0% \\ \hline 15.0% & 25.0% \\ \hline \end{tabular} Expense Assumptions Salary \& Benefits Advertising Selling, Gen. \& Adm Misc. Tax Rate Base Year \begin{tabular}{|r|} \hline 26.0% \\ \hline 2.0%5.0% \\ \hline 3.0%7.0% \\ \hline 2.1% \\ \hline 35.0% \\ \hline 2015 \\ \hline \end{tabular} INCOME STATEMENT SALES Textg Software Nonz-book General Total Sales Cost of Goods Sold Gross Profit OPERATING EXPENSES Salary \& Benefits Rent \& Utilities Advertising Selling, Gen. \& Adm. Mise. Total Operating Exp. Earnings Before Taxes Taxes 39 Net Profit After Taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts