Question: **please show formulas** This project is about preparing a pro form a income statement for a newly opened private bookstore. This book store expects sales

**please show formulas**

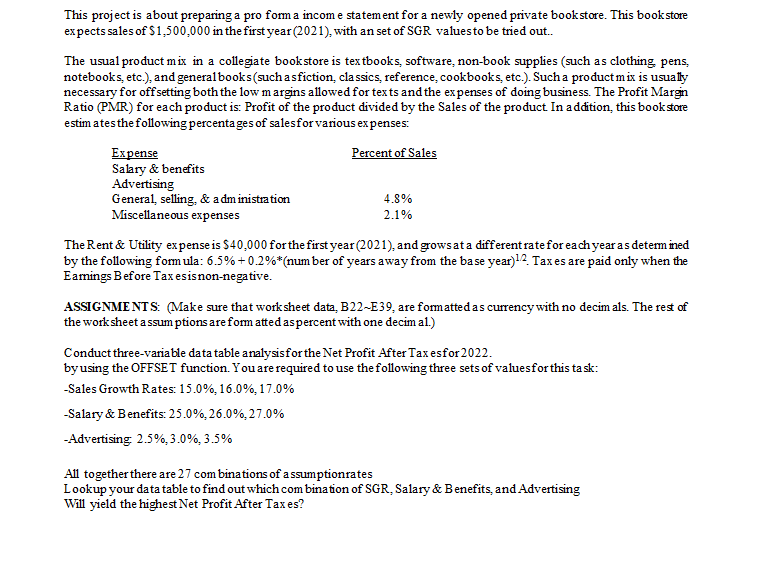

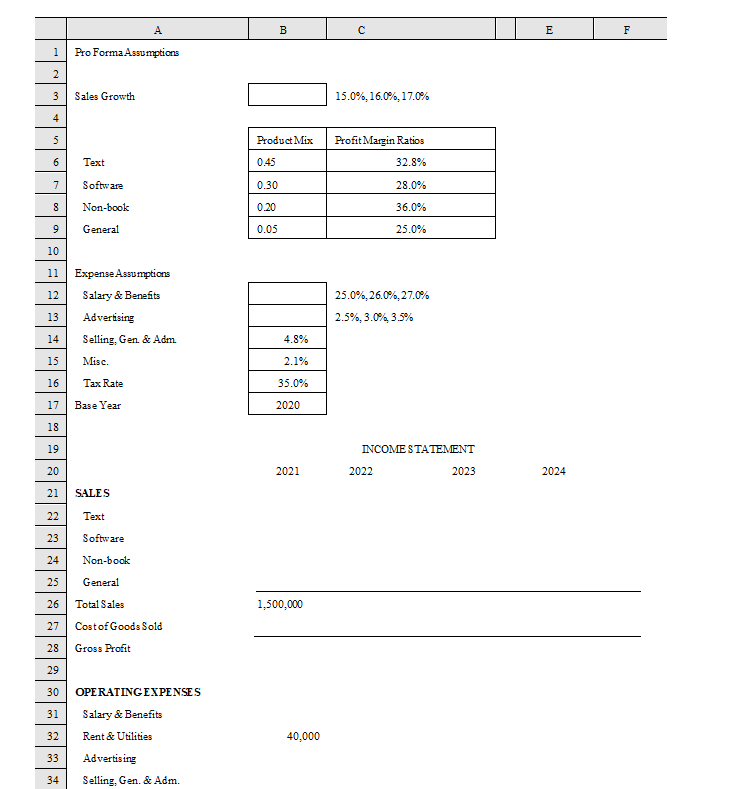

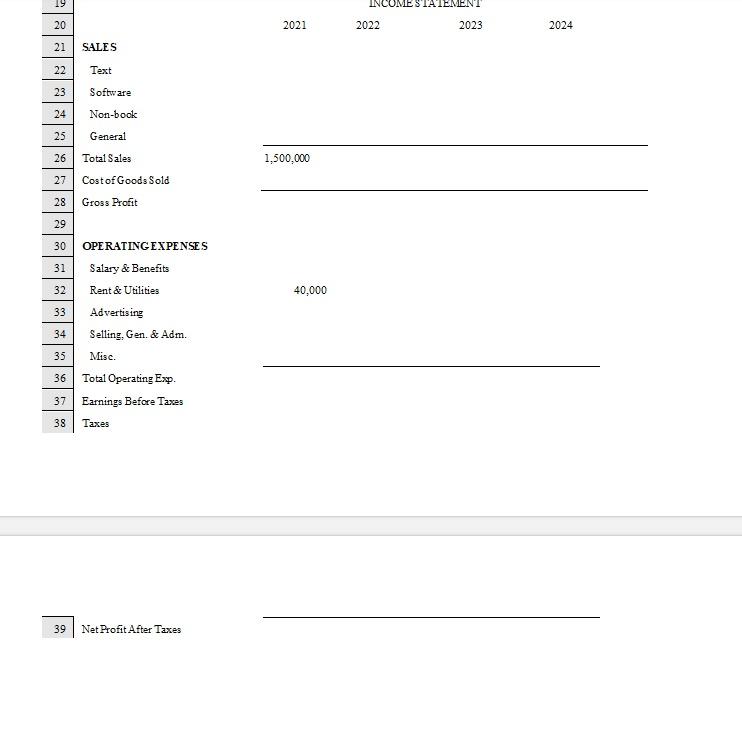

This project is about preparing a pro form a income statement for a newly opened private bookstore. This book store expects sales of $1,500,000 in the first year (2021), with an set of SGR values to be tried out.. The usual product mix in a collegiate bookstore is textbooks, software, non-book supplies (such as clothing pens, notebooks, etc.), and general books (such asfiction classics, reference.cookbooks, etc.). Such a product mix is usually necessary for offsetting both the low margins allowed for texts and the expenses of doing business. The Profit Margn Ratio (PMR) for each product is: Profit of the product divided by the Sales of the product In addition, this bookstore estim atesthe following percentages of salesfor various expenses: Expense Percent of Sales Salary & benefits Advertising General, selling, & administration 4.8% Miscellaneous expenses 2.1% The Rent & Utility expense is $40,000 for the first year (2021), and grows at a different rate for each year as determined by the following form ula: 6.5%+0.2%*(number of years away from the ba se year)12 Taxes are paid only when the Eamings Before Taxesisnon-negative. ASSIGNMENTS (Make sure that worksheet data. B22-E39, are formatted as currency with no decim als. The rest of the worksheet assumptions are form atted aspercent with one decim al.) Conduct three-variable data table analysisforthe Net Profit After Tax esfor2022. by using the OFFSET function. You are required to use the following three sets of valuesfor this task: -Sales Growth Rates: 15.0%, 16.0%, 17.0% -Salary & Benefits: 25.0%,26.0%,27.0% Advertising 2.5%, 3.0%, 3.5% A11 together there are 27 com binations of assumptionrates Lookup your data table to find out which combination of SGR, Salary & Benefits and Advertising Will yield the highest Net Profit After Taxes? A B E F 1 Pro Forma Assumptions 2 3 Sales Growth 15.0%, 16.0%, 17.0% 4 5 Product Mix Profit Margin Ratios 6 Text 0.45 32.8% 7 Software 0.30 28.0% 8 Non-book 0.20 36.0% 9 9 General 0.05 25.0% 10 11 Expense Assumptions 12 Salary & Benefits 13 Advertising 14 Selling, Gen & Adm 15 Misc. 25.0%, 26.0%, 27.0% 2.5%, 3.0% 3.5% 4.8% 2.1% 16 Tax Rate 35.0% 17 Base Year 2020 18 19 INCOME STATEMENT 20 2021 2022 2023 2024 21 SALES 22 Text 23 Software Non-book 24 25 General 26 1,500,000 27 Total Sales Cost of Goods Sold Gross Profit 28 29 30 31 32 OPERATING EXPENSES Salary & Benefits Rent & Utilities Advertising Selling, Gen. & Adm. 40,000 33 34 19 INCOME STATEMENT 20 2021 2022 2023 2024 21 SALES 22 Text 1,500,000 23 Software 24 Non-book 25 General 26 Total Sales 27 Costof Goods Sold 28 Gross Profit 29 30 OPERATING EXPENSES 31 Salary & Benefits 32 Rent & Utilities 33 Advertising 34 Selling, Gen, & Adm. 35 Misc. 36 Total Operating Exp. 37 Earnings Before Taxes 38 Taxes 40,000 39 Net Profit After Taxes This project is about preparing a pro form a income statement for a newly opened private bookstore. This book store expects sales of $1,500,000 in the first year (2021), with an set of SGR values to be tried out.. The usual product mix in a collegiate bookstore is textbooks, software, non-book supplies (such as clothing pens, notebooks, etc.), and general books (such asfiction classics, reference.cookbooks, etc.). Such a product mix is usually necessary for offsetting both the low margins allowed for texts and the expenses of doing business. The Profit Margn Ratio (PMR) for each product is: Profit of the product divided by the Sales of the product In addition, this bookstore estim atesthe following percentages of salesfor various expenses: Expense Percent of Sales Salary & benefits Advertising General, selling, & administration 4.8% Miscellaneous expenses 2.1% The Rent & Utility expense is $40,000 for the first year (2021), and grows at a different rate for each year as determined by the following form ula: 6.5%+0.2%*(number of years away from the ba se year)12 Taxes are paid only when the Eamings Before Taxesisnon-negative. ASSIGNMENTS (Make sure that worksheet data. B22-E39, are formatted as currency with no decim als. The rest of the worksheet assumptions are form atted aspercent with one decim al.) Conduct three-variable data table analysisforthe Net Profit After Tax esfor2022. by using the OFFSET function. You are required to use the following three sets of valuesfor this task: -Sales Growth Rates: 15.0%, 16.0%, 17.0% -Salary & Benefits: 25.0%,26.0%,27.0% Advertising 2.5%, 3.0%, 3.5% A11 together there are 27 com binations of assumptionrates Lookup your data table to find out which combination of SGR, Salary & Benefits and Advertising Will yield the highest Net Profit After Taxes? A B E F 1 Pro Forma Assumptions 2 3 Sales Growth 15.0%, 16.0%, 17.0% 4 5 Product Mix Profit Margin Ratios 6 Text 0.45 32.8% 7 Software 0.30 28.0% 8 Non-book 0.20 36.0% 9 9 General 0.05 25.0% 10 11 Expense Assumptions 12 Salary & Benefits 13 Advertising 14 Selling, Gen & Adm 15 Misc. 25.0%, 26.0%, 27.0% 2.5%, 3.0% 3.5% 4.8% 2.1% 16 Tax Rate 35.0% 17 Base Year 2020 18 19 INCOME STATEMENT 20 2021 2022 2023 2024 21 SALES 22 Text 23 Software Non-book 24 25 General 26 1,500,000 27 Total Sales Cost of Goods Sold Gross Profit 28 29 30 31 32 OPERATING EXPENSES Salary & Benefits Rent & Utilities Advertising Selling, Gen. & Adm. 40,000 33 34 19 INCOME STATEMENT 20 2021 2022 2023 2024 21 SALES 22 Text 1,500,000 23 Software 24 Non-book 25 General 26 Total Sales 27 Costof Goods Sold 28 Gross Profit 29 30 OPERATING EXPENSES 31 Salary & Benefits 32 Rent & Utilities 33 Advertising 34 Selling, Gen, & Adm. 35 Misc. 36 Total Operating Exp. 37 Earnings Before Taxes 38 Taxes 40,000 39 Net Profit After Taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts