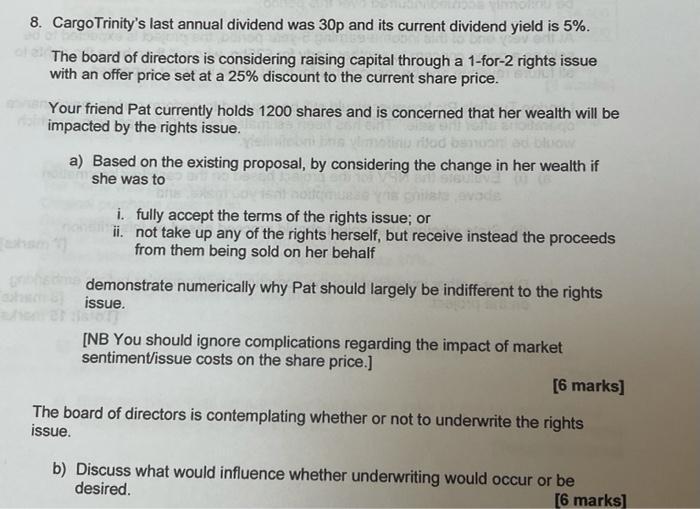

Question: Hy 8. Cargo Trinity's last annual dividend was 30p and its current dividend yield is 5%. The board of directors is considering raising capital

Hy 8. Cargo Trinity's last annual dividend was 30p and its current dividend yield is 5%. The board of directors is considering raising capital through a 1-for-2 rights issue with an offer price set at a 25% discount to the current share price. Your friend Pat currently holds 1200 shares and is concerned that her wealth will be impacted by the rights issue. rilad ban a) Based on the existing proposal, by considering the change in her wealth if she was to i. fully accept the terms of the rights issue; or ii. not take up any of the rights herself, but receive instead the proceeds from them being sold on her behalf demonstrate numerically why Pat should largely be indifferent to the rights issue. 081 [NB You should ignore complications regarding the impact of market sentiment/issue costs on the share price.] [6 marks] The board of directors is contemplating whether or not to underwrite the rights issue. b) Discuss what would influence whether underwriting would occur or be desired. [6 marks]

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Answer a Based on the existing proposal by considering the change in her wealth if she was to i fully accept the terms of the rights issue or ii not t... View full answer

Get step-by-step solutions from verified subject matter experts