Question: please show full working and for question 2 c please answer using the sharpe ratio. thank you Problem 2 (25 marks). Consider the following properties

please show full working and for question 2 c please answer using the sharpe ratio. thank you

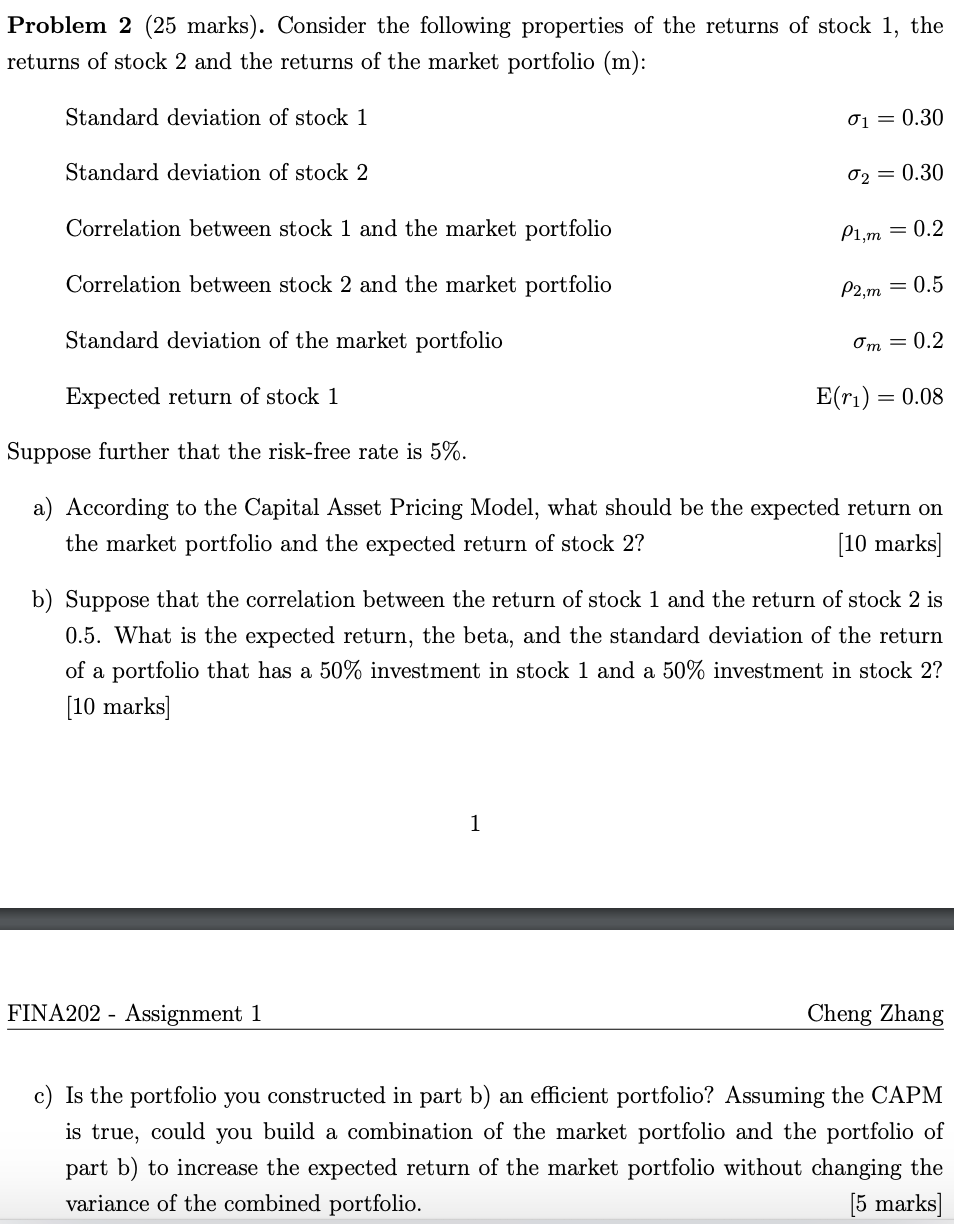

Problem 2 (25 marks). Consider the following properties of the returns of stock 1, the returns of stock 2 and the returns of the market portfolio (m): Standard deviation of stock 1 0.30 Standard deviation of stock 2 O2= 0.30 Correlation between stock 1 and the market portfolio P1,m = 0.2 Correlation between stock 2 and the market portfolio = 0.5 P2,m Standard deviation of the market portfolio Om= 0.2 E(ri) 0.08 Expected return of stock 1 Suppose further that the risk-free rate is 5% a) According to the Capital Asset Pricing Model, what should be the expected return on 10 marks the market portfolio and the expected return of stock 2? b) Suppose that the correlation between the return of stock 1 and the return of stock 2 is 0.5. What is the expected return, the beta, and the standard deviation of the return of a portfolio that has a 50% investment in stock 1 and a 50% investment in stock 2? 10 marks 1 Cheng Zhang FINA202 Assignment 1 c) Is the portfolio you constructed in part b) an efficient portfolio? Assuming the CAPM is true, could you build a combination of the market portfolio and the portfolio of part b) to increase the expected return of the market portfolio without changing the variance of the combined portfolio. 5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts