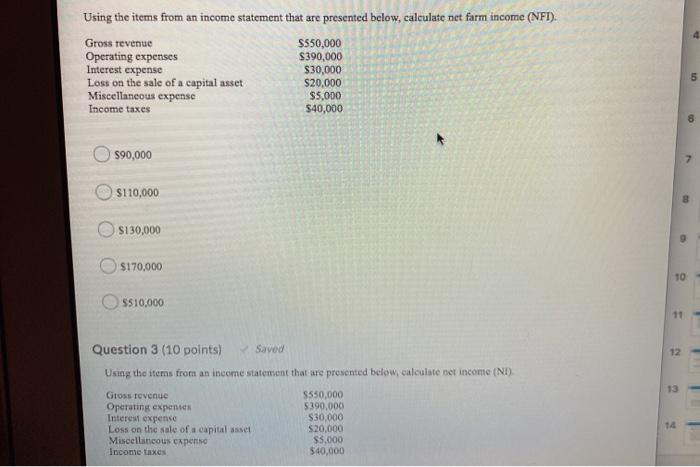

Question: Using the items from an income statement that are presented below, calculate net farm income (NFT). Gross revenue $550,000 Operating expenses $390,000 Interest expense $30,000

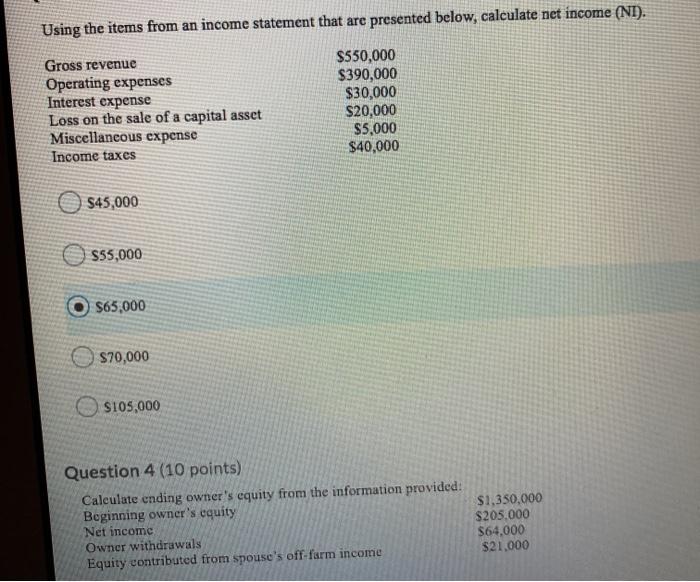

Using the items from an income statement that are presented below, calculate net farm income (NFT). Gross revenue $550,000 Operating expenses $390,000 Interest expense $30,000 Loss on the sale of a capital asset $20,000 Miscellaneous expense $5,000 Income taxes $40,000 5 $90,000 7 $110,000 S130,000 $170,000 10 5510,000 11 Question 3 (10 points) Saved 12 Using the items from an income statement that are presented below, calculate net income (NI). 13 1 Gross revenue Operating expenses Interest expense Loss on the sale of a capitale Miscellaneous expertise Income taxes 5550,000 $390,000 $30,000 $20,000 $5,000 $40,000 - Using the items from an income statement that are presented below, calculate net income (NI). Gross revenue Operating expenses Interest expense Loss on the sale of a capital asset Miscellaneous expense Income taxes $550,000 $390,000 $30,000 $20,000 $5,000 $40,000 $45,000 $55,000 $65,000 $70,000 S105,000 Question 4 (10 points) Calculate ending owner's equity from the information provided Beginning owner's equity Net income Owner withdrawals Equity contributed from spouse's off-farm income $1,350,000 $205,000 $64.000 $21.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts